Year End Review of 2025

Bouncing Back

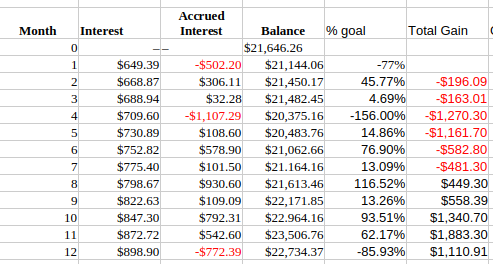

2025 started pretty rough, which you can see by looking at my first half review, but the 2nd half was, overall, much better and I did bounce back quite a bit. Here's a quick look at each month of 2025:

So, you can see I worked my way back to profitability for the year with only 1 bad month (December) which was driven by one bad trade. Sadly, that's how trading can go and I need to continue to work to minimize those in order to reach my goals. Speaking of goal, while I did better than last year where I barely broke even I came in at only 13% of my goal. To be fair, the goal is quite ambitious and getting even 75% of that goal would be a very successful year, this year did not meet my standards. That being said I did have some lessons that I will speak to later.

I won 82% of my trades in the 2nd half of 2025, which was a big improvement over the 63% in the 1st half. This brought my final win rate to 74% which is a bit under what I would expect given my style of trading. But, given the mess that was the first half, I'm ok with where I ended up on that front. The real area for improvement is, once again, keeping my losses under control. I had 2 bad losses in the 2nd half in total which lead to a draw down of $2,100. The other losses were reasonable. Cut that down to a more reasonable level of, say $850 and I made 30% of goal which given the first half would have been very good. This is why the size of losses is so important. A win rate of 74% looks great, but it matters how big the losses are compared to the wins.

More Visualizations

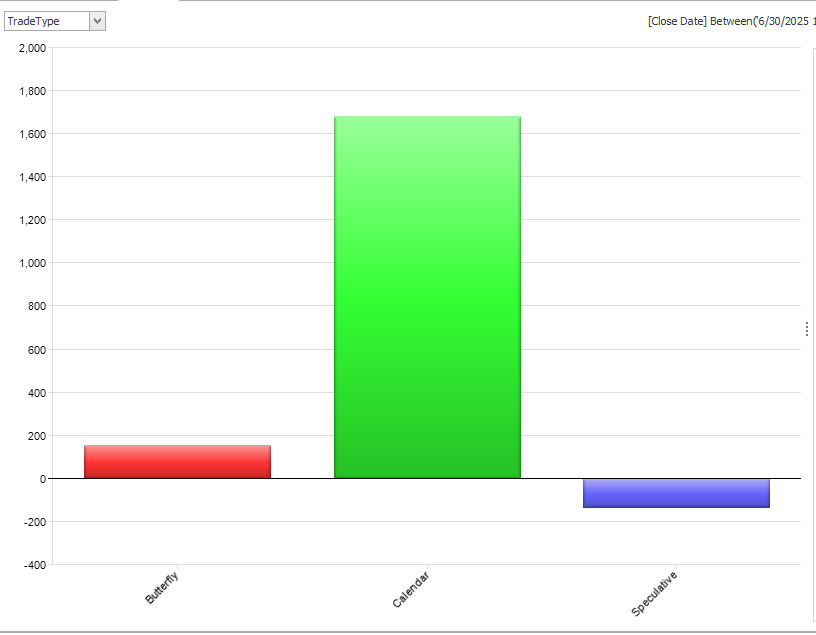

Next, let's look at the usual visualizations to see if anything stands out. I'll start with trade types:

Obviously, calendars were the trade for the later half of the year, but this had more to do with the fact that I did so many more of them as implied volatility was lower than the first half and I traded much more long vega trades. The one speculative trade was a small earnings play in COST. I rarely do earnings plays and this is why...I'm not good at picking direction. I might do one again, but it will be rare.

Obviously, calendars were the trade for the later half of the year, but this had more to do with the fact that I did so many more of them as implied volatility was lower than the first half and I traded much more long vega trades. The one speculative trade was a small earnings play in COST. I rarely do earnings plays and this is why...I'm not good at picking direction. I might do one again, but it will be rare.

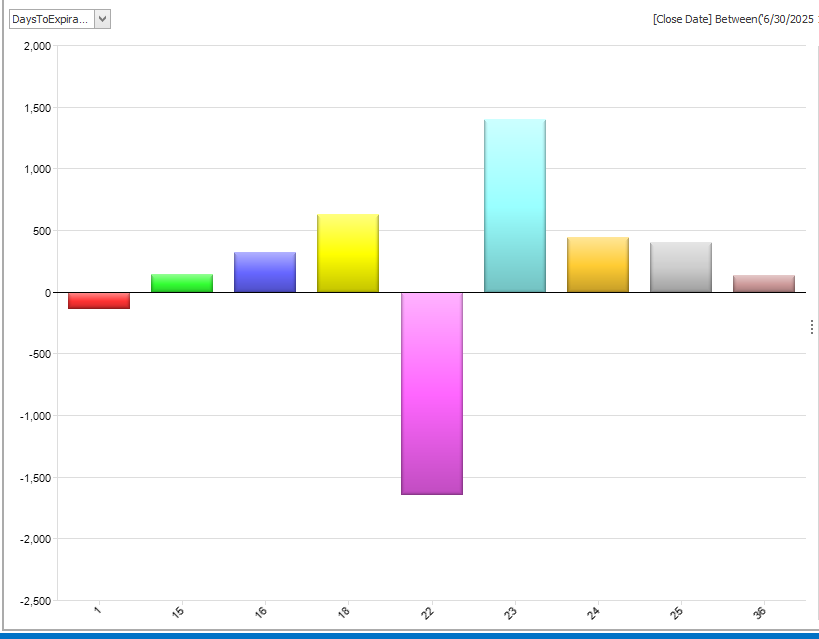

Next, let's look at days to expiration:

Overall all my DTEs worked ok. The 22-day stat is skewed a bit with the big loss at the end of the year. Most of my trades were between 18 and 24 days and that is where I am most comfortable. I decided at the end of last year to do fewer shorter term trades and I followed through with that in 2025.

Overall all my DTEs worked ok. The 22-day stat is skewed a bit with the big loss at the end of the year. Most of my trades were between 18 and 24 days and that is where I am most comfortable. I decided at the end of last year to do fewer shorter term trades and I followed through with that in 2025.

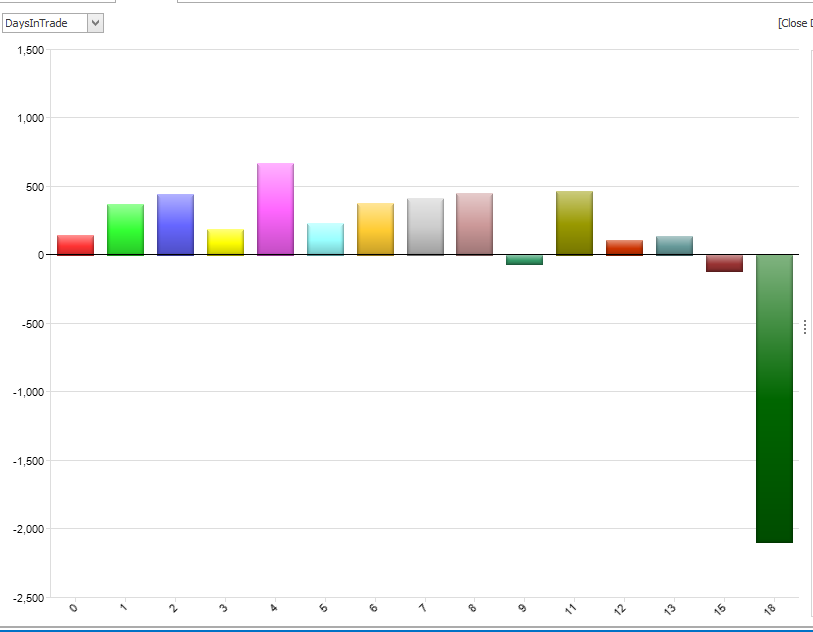

Next up, days in trade:

Again, this chart is skewed by the big loss at the end of the year. That being said, 10 days and less is the real sweet spot for my style of trading. At 10 days, I need to put the trade on a short leash.

Again, this chart is skewed by the big loss at the end of the year. That being said, 10 days and less is the real sweet spot for my style of trading. At 10 days, I need to put the trade on a short leash.

The Big Lesson

One big change I made in my trading style in the 2nd half is what I like to call incremental adjusting. I should do a separate blog on this at some point. The idea is to be bit more aggressive on when I adjust but less aggressive on how much I adjust a trade. In the past I would wait longer and adjust more. That can work, but it made my trades more vulnerable to whipsaws which lead to more losses. By adjusting smaller, I was less affected by a wilder back and forth market and I think it really helped. It's not perfect, as the big loss in December proved...but I plan to continue this method of adjusting into 2026 while being open to tweaking it as I learn more.

Conclusion

Overall, I am pleased with the 2nd half of 2025. Incremental adjusting along with being more flexible with VIX levels in the choice of my trades made me a better trader. I still have a ways to go, but the goal is to keep getting better which I think I did. This is a long journey of learning...probably longer for me than many people. My hope is that sharing my journey will help others as well as myself.

This content is free to use and copy with attribution under a creative commons license.