Mid Year Review for 2025

Recovering From a Rough April

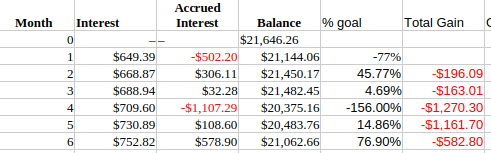

2025 started out as a challenging year for my trading. I had 2 bad months, one particularly bad, and the rest I didn't make my goal. But I did end stronger and am on my back to break even.

April was particularly rough. To be fair, the market was a bit crazy as that's when all of the tariff stuff started in the US but, as a trader, I have to be able to trade the market properly regardless of conditions. On the plus side, I followed up April with 3 straight months (4 if you count July) of net gains so I got back on track and am trading much better.

Overall I won 63% of my trades which is below my normal win rate which is more like 75%. This was mostly due to a very rough start. But only 2 of those losses were particularly bad. Losses happen, but not all losses are created equal. My rule of thumb is that a loss should not take out more than 2 wins. Not to my surprise, both of those bad losses were in April. So, it's safe to say, that April messed up the first half of the year.

More Visualizations

Let's see what else I can learn from my trading over the first half of the year.

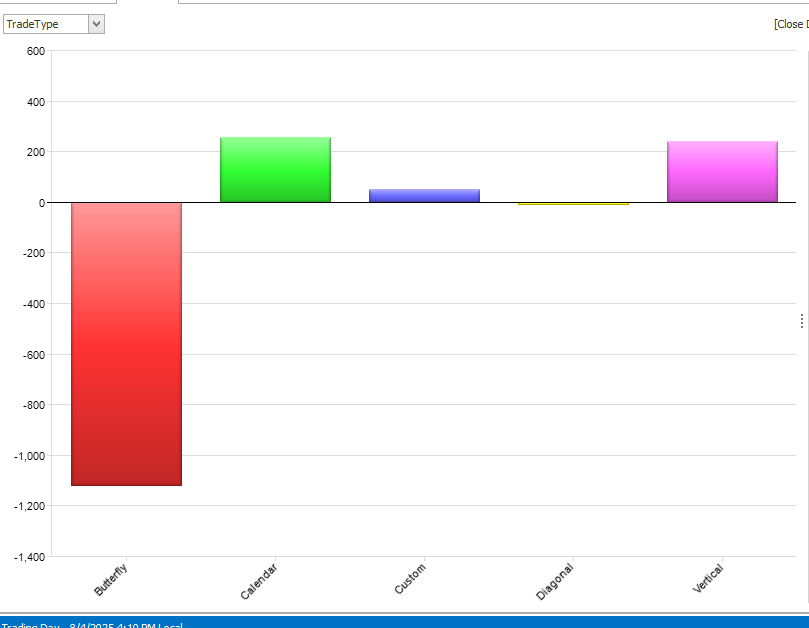

First, let's look at the types of trades as this is interesting:

Calendars worked much better than butterflies. Lots of volatility likely explains that. Even now, I'm trading calendars almost exclusively. Something happened with IV that took me a while to notice. It moved to a higher range than in previous years. Normally, I would consider 16.5+ in the VIX to be a high volatility environment and would deploy short vega trades like butterflies. But with the chaos of the world this year, a 16 VIX is low IV. Take a look at VIX over the first 6 months of the year:

The low end of that range is around 16. Now, I would start looking at going short vega somewhere between 20 and 25. Figuring this out changed my trade choices and, consequently, improved my results. The lesson for me here is to not rely the markets of the past. Pay more attention to the recent market and trade accordingly.

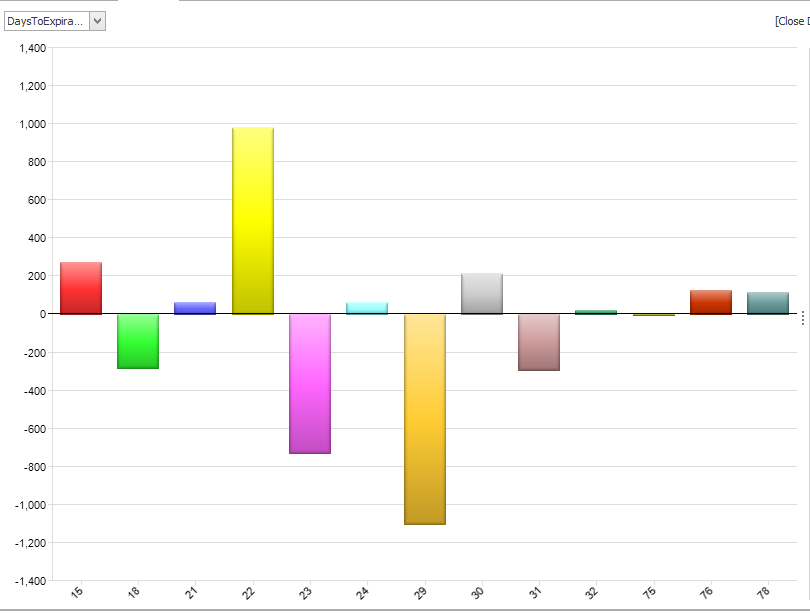

Next, let's look at the days to expiration.

The sweet spot continues to be around 3 weeks out. Note that this is also where I tend to put my calendars while my flies were out closer to 30 days. So this may be a bit skewed by the trade choice. But it still tells me that calendars around 3 weeks is a good place for me.

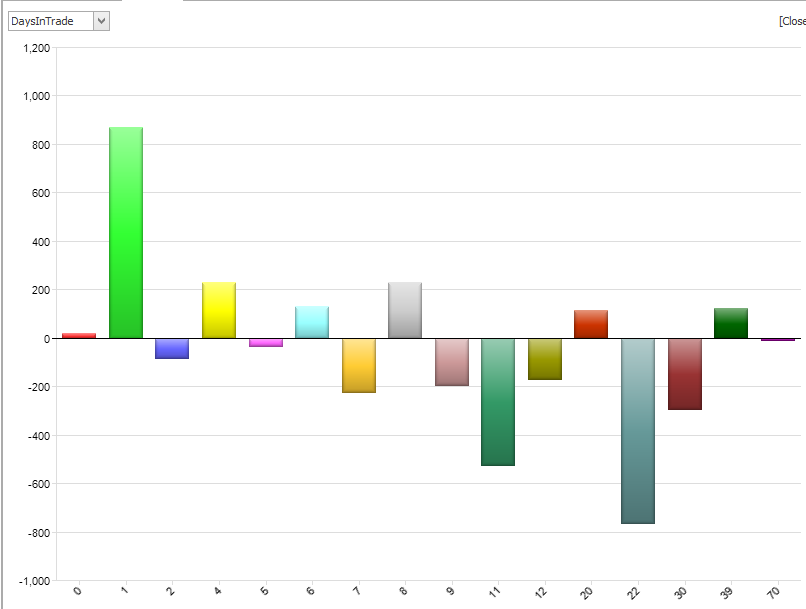

As far as days in trade:

Staying in a trade for more than a week was dangerous. I think this is also skewed a bit by trade choice but, overall, the being in a trade for a shorter amount of time is usually better for me. If I'm staying in for a long time, it usually means I'm adjusting which, in and of itself, isn't bad, but it indicates that the market moved against me so it will be more difficult.

Conclusions

While the first half of 2025 was challenging, it made me better overall. The big lesson around paying more attention to recent IV should serve me well moving forward. Had I realized that sooner, I may have been able to avoid some bad situations. But that's what this journey is about...learning. I hope you learned something as well.

This content is free to use and copy with attribution under a creative commons license.