Year End Review for 2024

2024: The Year of the Mulligan

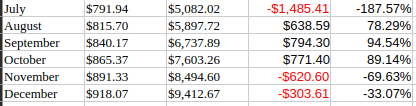

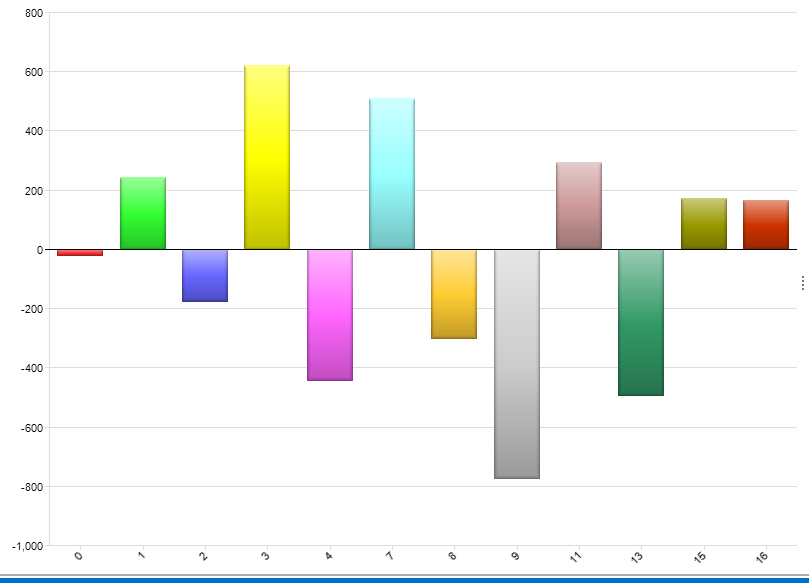

2024 was a challenging year for me. It started out very well, but from the middle of the year on, it was mostly down. I ended the year just above break even at $64.16 for the year. Way too work for that little money. :)

So I had 3 good months, but not nearly enough to make up for the bad ones. There's just no way to sugarcoat this. I didn't trade well. In the 2nd half of the year I won 66% of the time. I did better in the first half which brought my win rate for the year up to 73% which isn't horrible, but not my usual 80% of past years. The problem is that on average my losses were twice as big as my wins so even though I won more than I lost, I can't make money taking that many losses.

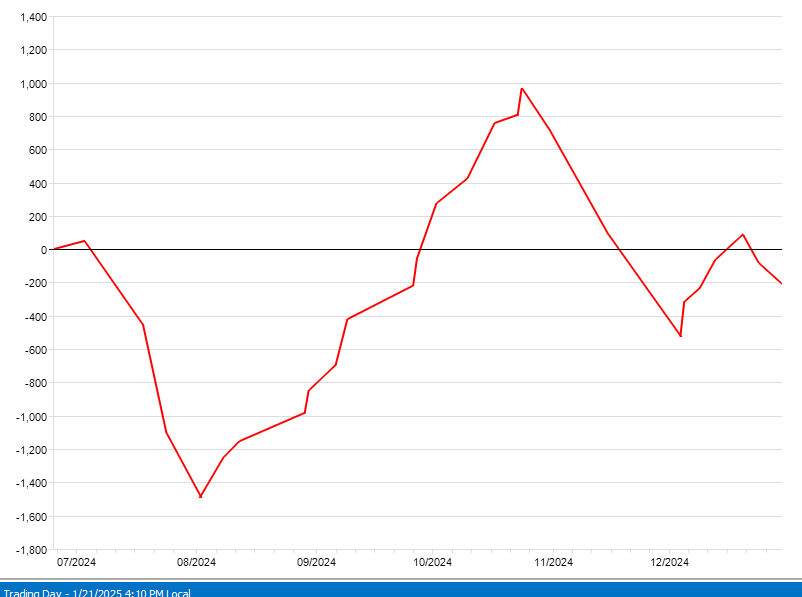

Looking at the equity chart for the 2nd half, July and November were particularly bad. I say that roughly because some of the trades were carried over from the previous month, but that's where I had the most issues.

So what was going on in those months?

The pattern I see that caused me issues was a big drop followed by a quick rebound. As I'm a range-bound trader, this makes sense. While I do well in a back and forth market, if it's that spastic, it's a problem for me. I need to handle those markets better, probably by getting out and waiting more rather than playing them. At a minimum, I have to trade smaller when the market gets rough. I did, however, manage one spec trade on VIX that did well in the August 5, mess.

Other Visualizations

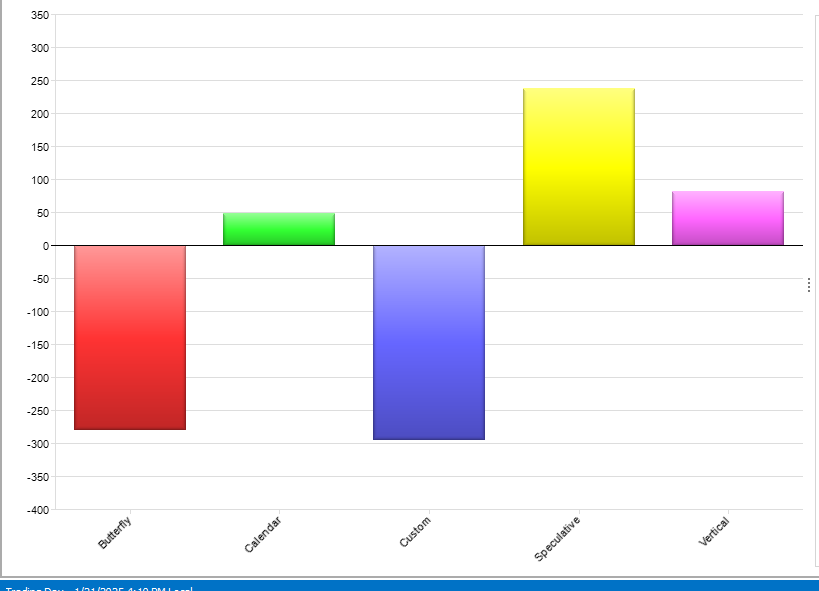

I have some observations from my performance charts. It looks Calendars did better overall vs Butterflies. The rest of the trades were tiny and not really consequential.

Note: The “Custom” trades were the short term fly/calendar combos that I was playing with. I concluded that I really don't like them and will likely not continue doing them, but it was good to try them. The “Speculation” trade was the VIX vertical that I did when VIX spiked in August.

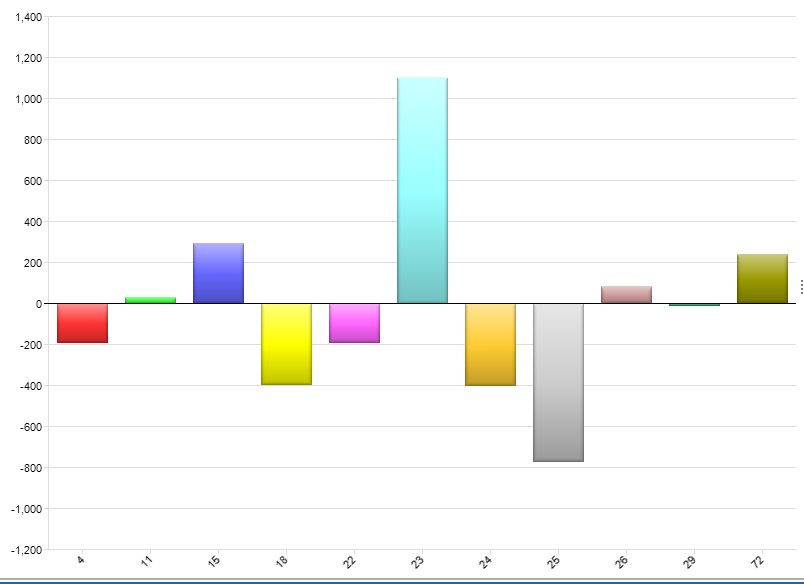

I also confirmed that I don't really do well super short term. I did experiment with a couple of them and they really don't fit my style. My plan is to stick to > 10 DTE this coming year with most trades being around 20 DTE which seems to be my sweet spot.

With respect to days in trade, I do best when I'm out in less than a week. Once a trade gets over a week old, I need to start getting strict about whether I stay in or not. This gets back to my “Pets vs Cattle” mantra.

Wrapping Up 2024

While it was a rough year, I stayed in the black and I think I learned something about me and how I trade. And that is the purpose of doing these reviews. Now I need to hold myself accountable for executing on the lessons learned. Stay tuned to see how I do. I hope this kind of review helps you in your trading.

This content is free to use and copy with attribution under a creative commons license.