Pets vs Cattle: My Biggest Trading Lesson

Originally posted January 9, 2020

In the years I’ve been trading, I’ve learned many things. Of course, I started out with the mechanics of options, the Greeks, the strategies, etc. If you are interested in these fundamentals, check out my video series Options Fundamentals here on the the site or on my BitChute channel. I go over many of those early lessons about options trading.

But the craft of trading is more than just understanding the mechanics. Trading is also psychology. Paper trading is a useful tool, but you will never get the full experience until you are trading live money, your hard earned money. The ups and downs of the market become much more meaningful. It’s easy to get obsessed or stressed about your trades. The financial investment can lead to an even bigger emotional investment. Your idea is sound. Your plan will work. You have the skills to fix things when the market moves against you. You will make that profit. While confidence is certainly needed when one is in the risk management business (and that’s how I see options trading), you must be able to look at your trades as assets in your business. After all, what are options? They are simply contracts, a set of obligations that we exchange with others. They are derivatives of pieces of paper that represent ownership rights. Or in my case, as one who trades mainly the SPX, I trade a derivative of a derivative of pieces of paper which represent ownership rights.

Why do I say all of this? Because recognizing this has helped lead me to the biggest lesson I’ve learned in trading so far. And the analogy I use is “Pets vs Cattle”. Bear with me for a bit and (I hope) it will all make sense.

If you have pets, as I do, you understand that they are more than just animal companions. To many of us, our pets are part of our family. We do our best to take care of them, feed them, get their shots, make sure they have the best life we can give them. When they get sick, we collectively spend billions of dollars a year getting them the best medical care we can. When they die, we mourn them. And, outside of truly obsessive behavior, all of that is perfectly fine and normal. We take in these animals, keep them in our homes and our lives and treat them and protect them as our own.

If you have pets, as I do, you understand that they are more than just animal companions. To many of us, our pets are part of our family. We do our best to take care of them, feed them, get their shots, make sure they have the best life we can give them. When they get sick, we collectively spend billions of dollars a year getting them the best medical care we can. When they die, we mourn them. And, outside of truly obsessive behavior, all of that is perfectly fine and normal. We take in these animals, keep them in our homes and our lives and treat them and protect them as our own.

However…..

A farmer or rancher also has animals. He takes them in, feeds them, and protects them. But it’s very different. Those animals are not part of his family. His goal is to eventually sell these animals to make his living. If one of his animals gets sick, he is far less patient with medical care. Time and costs matter and he can’t let one sick cow infect the entire herd. While he may try some limited things to make that cow better, if that fails the cow must be put down and he moves on and focuses on the rest of the herd. To the rancher, the animals are a business asset. They exist to make him money to feed and protect his family (and his family’s pets). But he doesn’t have the emotional attachment to his cattle like he has with his pets.

A farmer or rancher also has animals. He takes them in, feeds them, and protects them. But it’s very different. Those animals are not part of his family. His goal is to eventually sell these animals to make his living. If one of his animals gets sick, he is far less patient with medical care. Time and costs matter and he can’t let one sick cow infect the entire herd. While he may try some limited things to make that cow better, if that fails the cow must be put down and he moves on and focuses on the rest of the herd. To the rancher, the animals are a business asset. They exist to make him money to feed and protect his family (and his family’s pets). But he doesn’t have the emotional attachment to his cattle like he has with his pets.

So, let’s bring this back to trading. After learning the basics of trading, I struggled mightily with consistency. I knew how to win. But for ever few wins I’d get, one loss would wipe most, if not all, of those wins out. I just couldn’t get ahead and actually make any money that way. Losses happen in any business. You can’t avoid them. If you never lose, you never really took any risk and, as I said earlier, risk is how the options market pays traders.

So, I started critically reviewing my trades, especially the big losses. I needed to find what was common in my losses as well as what was common in my wins. And what I found was that when I would lose too much, most of the time I was holding onto a position too long trying to fix it and try make it profitable. I was adjusting my positions every time they went against me and was sticking with them stubbornly to try to make a bad trade work. In short, I was treating my trades like pets. I became emotionally attached to them. I knew if I just did more more adjustment, it would come back. This would go on until finally I was down so far that I finally gave up. A trade that I was trying to make a 10% profit was now down 35-40%. And when I tallied up my trades at the end of the month, it was those one or two bad losses that was the difference between a good month and a bad month.

I needed to change my attitude. I needed to see these trades for what they really were. My trades are my cattle. And like any herd of cattle, some won’t make it to market and that’s ultimately ok. But I can’t let one sick trade infect my account. Every trade takes up capital in my account. There are times when the best thing I can do is close the trade and re-deploy that capital into a new one that could be a winner.

So how am I applying this to the real world? First, before I put on a trade I always have a plan. That plan starts with the setup of the trade, the profit target, and the max loss. But the plan goes further. It also states what I will do when a trade moves against me. I have a plan for the upside as well as the downside. My plan then has the details for subsequent adjustments if needed. That’s all well and good, but I needed something more because just doing that wasn’t helping me avoid these bad losses. So I added some guidelines to my plan which I call my “Pets vs Cattle” rules to remind me of why I made them.

Guideline #1: I don’t adjust in the first 3-4 days. What I found was that when my trade went against me early and I started adjusting, I rarely made it back and it would have been better had I just closed the trade instead of adjusting at all. My trading style relies on Theta (time decay). Because I sell more extrinsic value than I buy, time works for me. But adjustments cost money, either by putting more cash or margin into the trade or taking a loss on part of the structure. So I’m sinking more capital into the trade to, essentially, buy more time for it to work. But if I do that very early in the trade, I haven’t really accumulated much time decay from which to draw. So I was digging myself into a deeper hole before realizing much Theta in the trade. And when I looked at the position at the first adjustment, it was usually a small loss or sometimes even a small gain or near break even. Here’s an example:

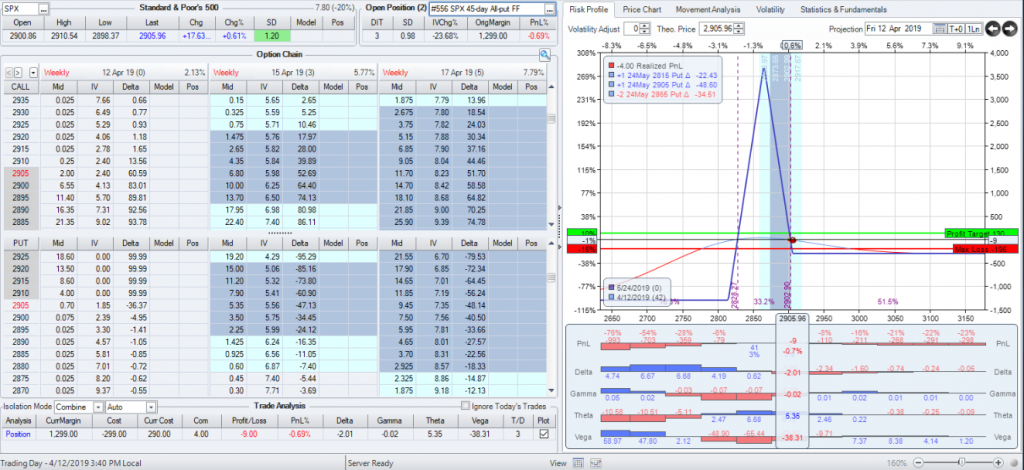

An example of a good loss.

So here I had my standard SPX 45-day butterfly. This shot was taken 3 days into the trade and I was already just outside of my butterfly tent. This is normally an adjustment point for me. But, instead I took the trade off for a loss of about $13 after expenses. On a $1300 trade, that’s about a 0.7% loss. Could I have adjusted here and saved it? Maybe. But if the trade goes against me this quickly, I’d rather just take it off and re-deploy the capital. Making up $13 on another trade is much easier than making up a max loss. This trade is cattle and I’d rather not sink more money into it if it’s not working early. Had this been day 5, I’d certainly consider adjusting, but not on day 3. (At 4 days, it’s a judgement call, thus the guidelines says 3-4 days).

Guideline #2: I consider taking off a trade that is at an adjustment point and up money. So assuming I’m past at or past the 4 day mark, if I’m at an adjustment point and up money, I could adjust it and try for more. But, more often than not, I’ll just take it off and re-deploy the capital. If the market gives you a profit, there’s nothing wrong with taking it. Generally if I’m up at least 4%, it’s a no-brainer to take it off. Less than that is when I’d consider adjusting since I’m getting close to break even.

Guideline #3. I limit the number of adjustments to around 4-5. Another observation I noticed in my bad losses was I was over-adjusting. This is somewhat related to the guideline #1 as adjusting too early can lead to over-adjusting. But as each adjustment costs money at some point I have to stop digging and move on. If I hit this limit, I take off the trade even if I’m not yet at my max loss. If I’ve adjusted 4-5 times in a trade, that’s a sign that the market conditions aren’t good for that particular trade and it’s best to take it off and either wait for things to calm down or put on a trade that is more conducive to the current market.

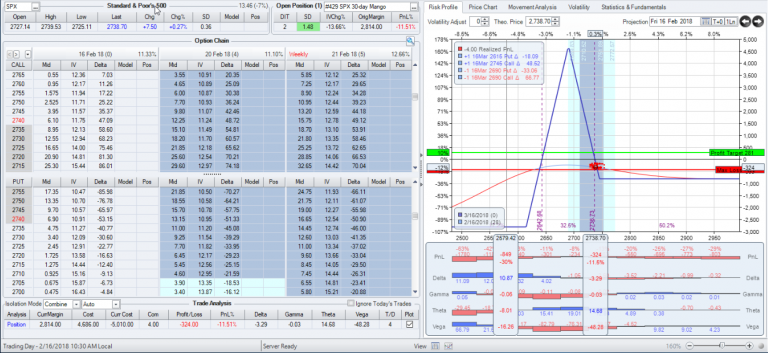

Ok, this blog would not be complete without an example of not following these rules so here it goes. On this trade back in 2018 (before I established my guidelines), I was doing an Iron Butterfly. My first adjustment came in day 2. I then went on to make 8 adjustments before taking a bad loss. Here is what the trade looked like on day 2 when I made my first adjustment

Bad loss after 8 adjustments in 15 days!

Ugh! I finally closed it for a loss of $1,145 or about 40%! So as bad as it may have felt to have lost $324 after 2 days. I’d take that over losing $820 more. But I was treating this trade like a pet, not cattle. Had I just cut my losses on day 2, I would have lost $324 but I could have re-deployed that capital and perhaps even made some or all of it back in the next 2 weeks. And it’s certainly easier to make up $325 than $1150.

So, hopefully, I’ve shown why a silly mantra of “Pets vs. Cattle” helped make me a better trader. I still say this to myself today whenever I’m tempted to break one of my guidelines. I put it in my trade notes when I close a trade early. This little phrase helps keep me from getting too attached to my trades. It reminds me to not get emotionally invested in my trades. Losses will happen and are ok as long as they are small losses. Maybe this can help you too.

As always, feel free to leave me feedback here on the site or reach out via email at midway@midwaytrades.com.

Good Trading!

This content is free to use and copy with attribution under a creative commons license.