Year End Review: 2023

A Similar but Better Tale

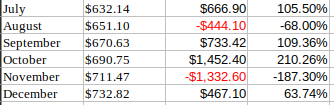

I called 2022 “A Tale of Two Halves” and 2023 ended up similar. Once again, the first half of the year was very good and the second half was less consistent. However, I did better in 2023 than I did in 2022 in most ways. I only had 3 losing months, 2 months where I made money but didn't make my goal, and 7 months where I made or exceeded goal 3 of which I more than doubled my goal.

November was really the only bad month. I had a couple of bad trades one of which got caught in a big gap up. I was having a lot of success leaning bearish in October and the winds shifted. That's one lesson I'll take from 2H 2024.

However, last year I made an annualized return of 8%. This year I made 30%. Neither one met my goal of 42.5% (3% per month), but I can safely say that I traded better in 2023.

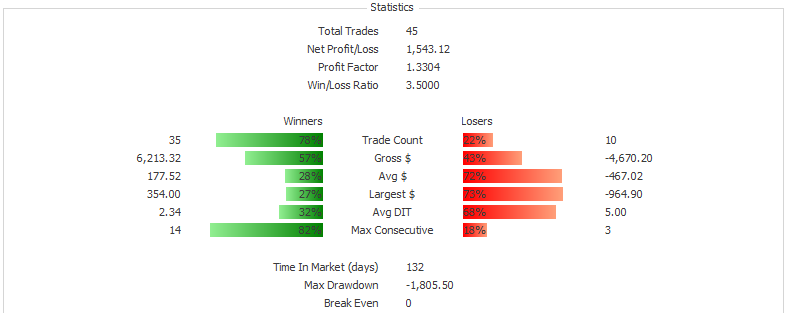

But back to 2H2023. I won 35/45 trades which is good. My main concern here is the average size of my wins vs the average size of my losses. While in 2H2023 it wasn't horrible, there is room for improvement and improving here will greatly help my overall earnings.

What Worked? What Didn't Work?

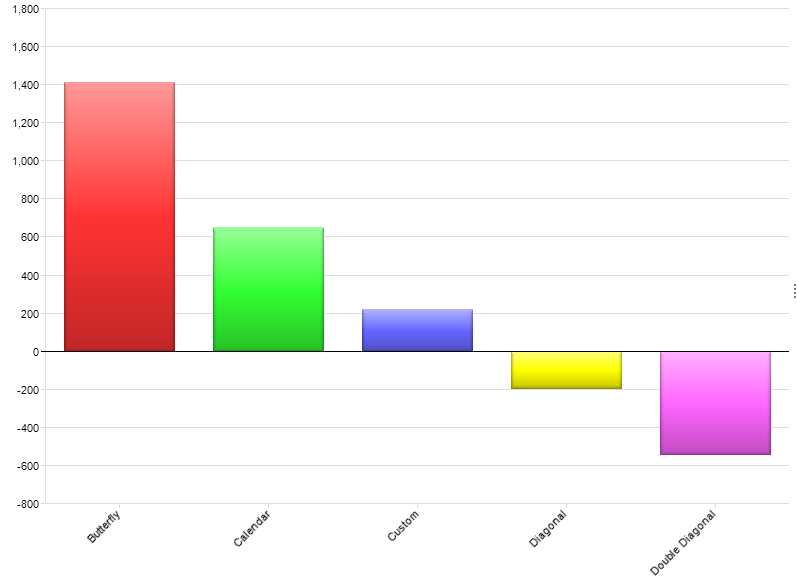

If I had to guess what worked the best in the 2H, I would have guessed calendars, but I was wrong, it was butterflies. This is why doing this kind of analysis is important. Ultimately I think I had a bit of recency bias as I did a ton of calendars near the end of the year, but in October especially my butterflies did really well as the market went down. That being said, my calendars did very well. I started experimenting with diagonals and double diagonals with very mixed results and both of them ended up being net losers. That's ok as I was really learning them this year. I would consider doing them again at some point, but if I do, I need to keep them small. (Note: The “custom” trade was actually a butterfly that I mis-labeled when I put it on).

Visualizations

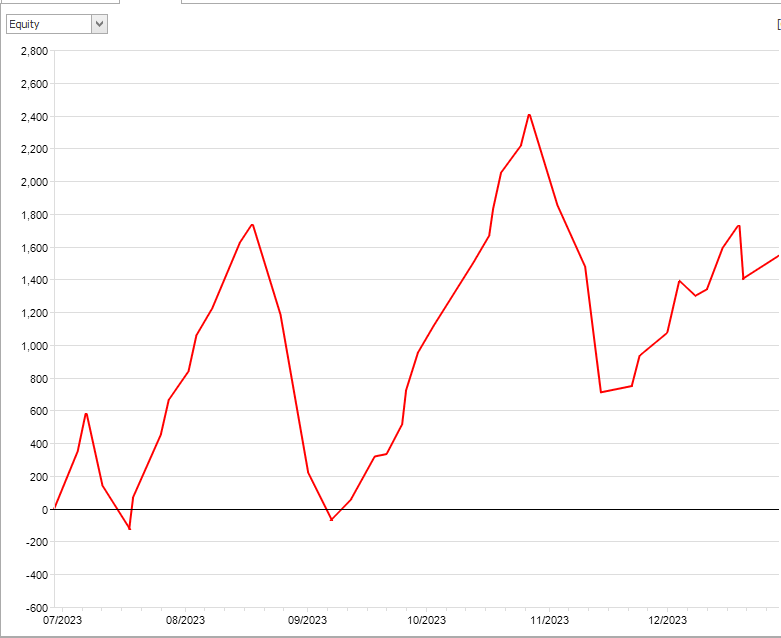

Here are a couple more charts that show some interesting things. First, this is my P/L over the course of the 2H2024.

What stands out to me here is the ups and downs on a monthly basis with the biggest swings being from October to November. November knocked out most of my impressive gains in October. Had November been break even I would have made my goal for the year. The lesson here is that if I can better keep losses under control, my goal which appears ambitious is very achievable.

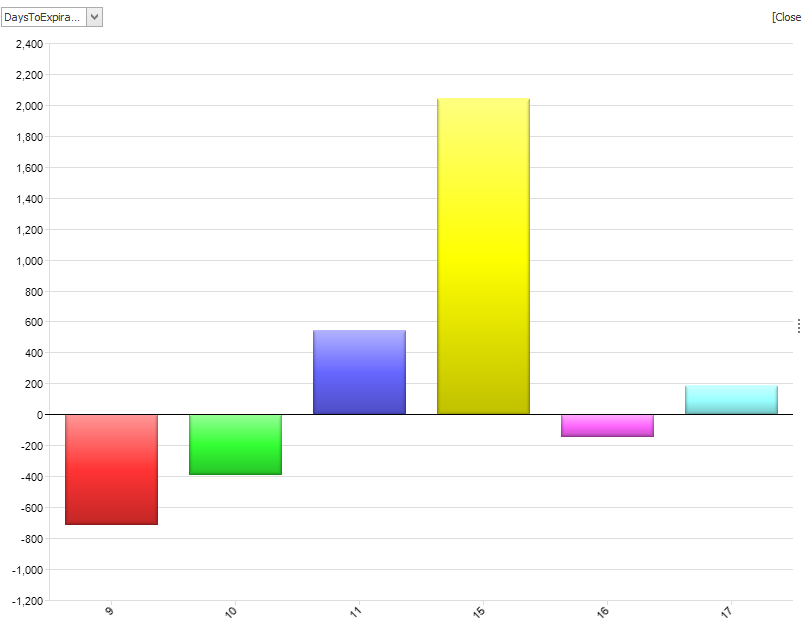

Next let's look at days to expiration. The sweet spot was clearly 11-16 days with the worst being 9 days which were likely my experiments with various diagonals. But this make sense as most of my trades fell in the 11-16 day range.

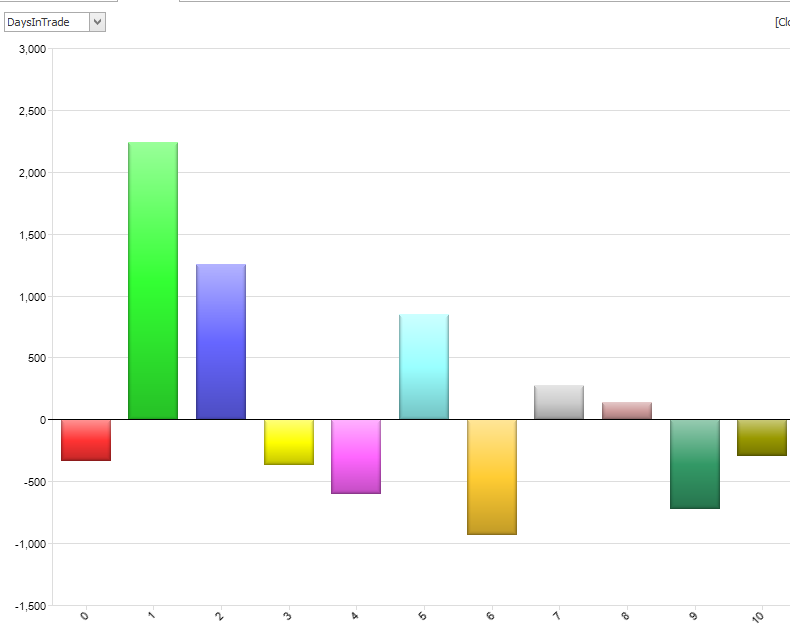

Finally, here is the days in trade. What I see here is that my best trades last 5 days or less. This is in line with other recent time periods. My good trades tend to work quickly. It's not that I can't stay in longer, but once they cross 5 days, I need to keep them on a tighter leash.

Thoughts on 2023

Overall, I'm happy with how I traded in 2023 as it was a big improvement over 2022 and previous years. The key to making the next jump is controlling the size of losses. I win enough trades to make good money but the difference between making good money and great money is the size of the losses. I'd like to see the gap between the average win and the average loss to shrink. It's ok for the average loss to be a bit higher but in the 2H of 2023 my average loss was about 2.5x the size of my average win. I'd like to get that closer to 1.5x, even 2x would be an improvement. If I can do that, I can make my goal of 3% per month. From the data above, being cautious of trades going over 5 days is one way to get there, along with better overall risk management and, of course, Pets vs Cattle.

Until next time...Good Trading!

This content is free to use and copy with attribution under a creative commons license.