Year End Review: 2022

Originally posted on January 16. 2023

Now that the books have closed on 2022, it’s time to do a year end review, specifically of the 2nd half of the year but, also, the year as a whole. As I stated in my first half review, the format of this is a work in progress so it may differ here than in the first half review. Eventually I will settle on a format I like that will properly and clearly show the progress of my trading.

A Tale of Two Halves

At a high level, I can really see a difference in the two halves of the year. I was pleased with my first half performance and disappointed with my performance in the second half. Of course, market conditions are different all the time but my long term goal is getting more consistent. It’s ok to lose on trades, everyone does and if I didn’t ever lose I would wonder if I was being too risk averse but, in this case, I had too many bad trades which caused me to miss my targets as many times as I made them with September being a particularly bad month. So without further adieu, here are the numbers:

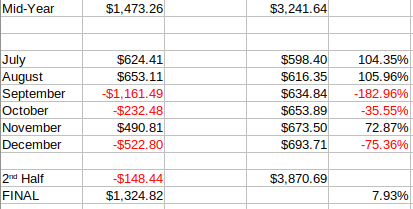

2H 2022 Summary

As you can see, I lost about $150 in the 2nd half, mostly due to September December. Thanks to a strong first half, I did end up making about 8% on the year, but that was far from my goal of 3% per month.

What Worked? What Didn’t Work?

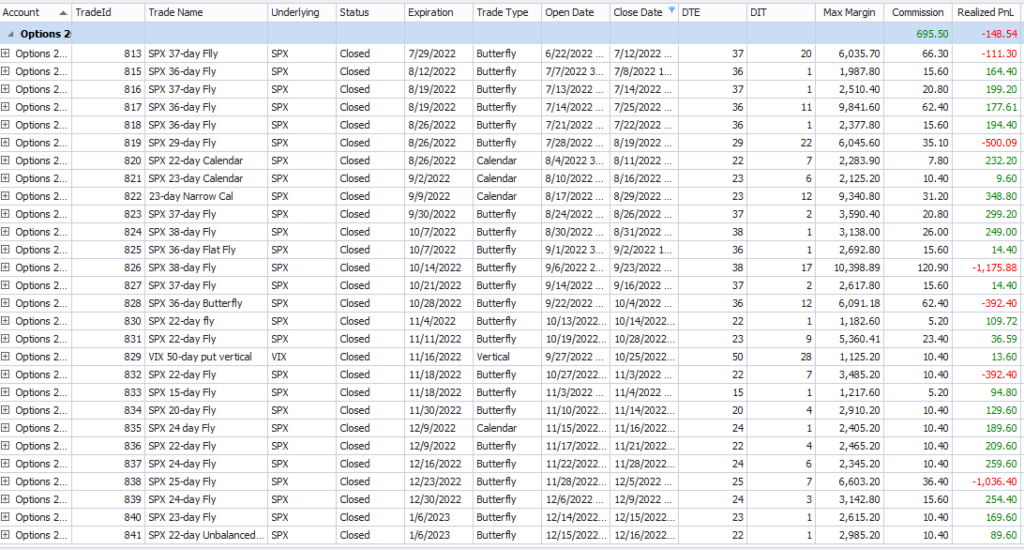

Butterflies dominated my trades in the 2nd half with all but 4 of my 28 trades being some kind of butterfly. So they encompassed all of the losses, but a big chunk of the gains as well. Volatility was high most of the time so it wasn’t really a good time for calendars. Volatility was so high at one point that I did a put vertical on VIX which is not my usual trade. It, essentially broke even so VIX plays were not a big part of the 2nd half of the year like they were in the first half. SPX Calendars did ok, but there just were not enough good opportunities to do them.

My 2022 Trades

Two trades really stand out as bad ones, the 2 SPX flies where I lost $2200 between them. Without those two trades I wouldn’t have made my 2H goal but it would have been at least closer to my performance in 1H. Overall, the SPX balanced butterflies was my go to trade during this time which makes sense given the volatility levels during the year. Calendars did well when I could put them on but those opportunities were limited.

I also experimented with some tweaks on my trades due to high volatility that overall worked well. I started doing wider butterflies (as wide as 80 up/down) and, in some cases, went shorter on the duration to limit exposure. To balance that out, I went smaller on those shorter duration trades to limit my risk as price risk on those are more than my usual, 22-30 DTE flies.

During this time, it wasn’t that trades didn’t work as much as it was my poor execution on losing trades. This needs to be a major focus going into 2023. My mantra of “Pets vs Cattle” is just as important now as it’s always been and I need to remember it.

Some Interesting Visualizations

So that is the raw data, but my modeling software offers some basic visualizations that I found to be interesting so I thought I’d include some here. Note: these are for all of 2022.

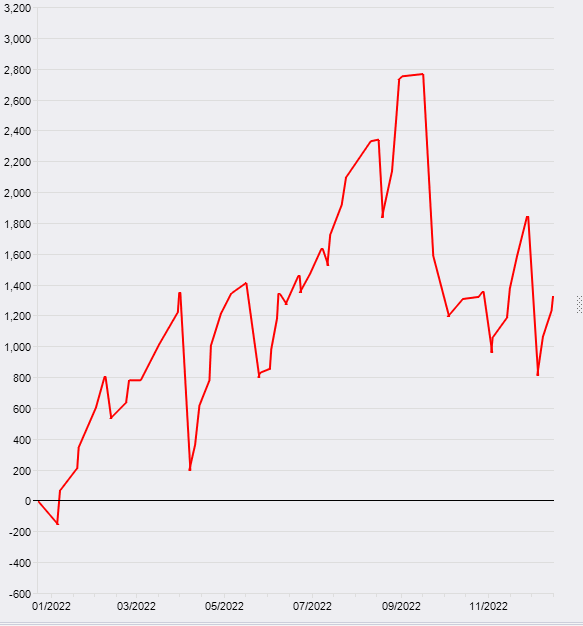

P/L in 2022

First is a basic P/L graph which spells out pretty much what I said in the summary, things were on the right path until September and then I really struggled.

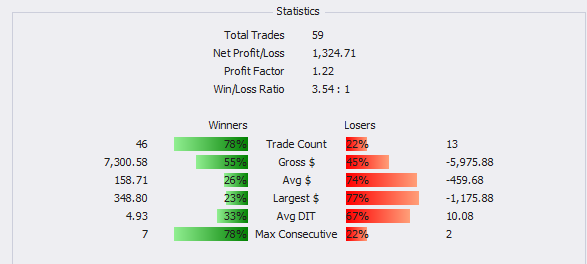

Trade Stats

This is shows why I don’t care about W/L ratios. I had 59 trades and had a 78% win ratio and my results weren’t that great. The key is the average loss size vs the average win size. My losses were about 2.8x my wins. So my W/L ratio saved me but if I can get the size ratio down, I’ll be far more successful.

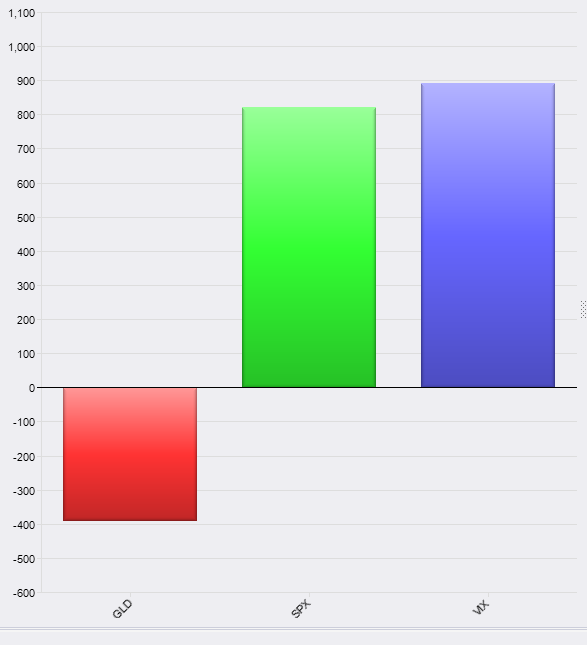

2022 Underlyings

I traded 3 underlyings this year, mostly SPX, but from a dollar net dollar amount, I made a little more in VIX than SPX. This is mostly because I didn’t have any losses in VIX. Almost all of those VIX wins were from the first half of the year. I honestly did not expect this one, but I’m glad I did those VIX trades as they really did help my overall performance. The GLD calendars were a failed experiment, but that’s ok. Once I saw they weren’t working I moved on. The key was I figured out why they weren’t working. It’s possible I may go back to GLD at some point, but what I was doing here clearly didn’t work.

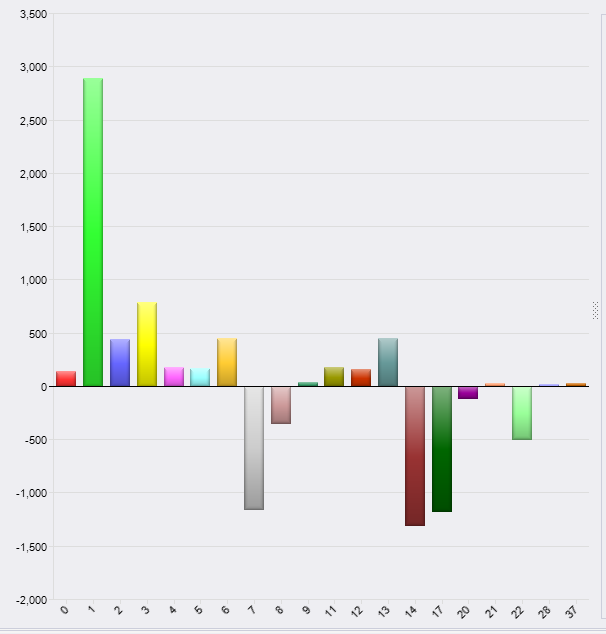

2022 Days In Trade

This one is quite interesting as it tracks P/L based on how long I stayed in the trade. This tells me that the vast majority of my profits came from quick wins (6 days or less). This was mostly due to quick drops on my balanced butterflies. But it also says that the longer I stayed in a trade, the worse I did. I did not lose any trade where I was in it for 6 days or less, but at 7 things change.

What this does tell me when I lose, I’m staying in too long. This matches up with my experience as my worst losses were because I was trying to fix bad trades. What this doesn’t tell me is that I should only be in trades for less than a week. My key takeaway here is to be willing to give up on a bad trade earlier but it’s ok if a trade takes a longer than a week to work. But that the longer I stay in, the worse my odds so once I cross the 1 week barrier, I should put that trade on a tighter leash and cut my losses sooner. It also shows my one day trade, which I find amusing because I really don’t day trade, but every once in a while it can make sense even for a boring trader like me. But it also shows that even though most of my trades start with 21-30 days to expiration, quick profits are very possible. You don’t necessarily have to do zero DTE to make money.

Final Thoughts on 2022

While I’m disappointed that I didn’t make my goal and especially disappointed in my 2nd half performance, I still made money in a very challenging year. If you use the S&P 500 as a benchmark I outperformed it (in this account anyway), by a mile as the S&P lost about 20% and I made 8%. So I’m not going to beat myself up over this year. But I do see it as a chance to learn and get better. And how many times can you get paid to learn?

So far, I think I like this format, but I may tweak it next year. Let me know what you think. Feel free to comment here or reach out directly at midway@midwaytrades.com. I always like talking options with people.

On to 2023…look for more blog posts here as well as follow my video series “This Week @Midway Trades” for weekly reviews of a real-world retail trader.

This content is free to use and copy with attribution under a creative commons license.