Understanding Risk

Originally posted on November 28, 2021

I had a very good conversation with a reader recently. He is getting started in trading options and was looking for ideas with the S&P 500 (SPX/SPY). As that’s what I do almost exclusively, I was glad to hear his ideas and give my opinions on them. But the conversation really turned into a discussion about risk. He, as well as many newer traders, want to find ways to “play it safe” and minimize risk while still making money. Of course, it’s not just newer traders who want this. I think everyone would be happy with a low-risk strategy that makes money. The reality is that this business is a risk management business. We, as options traders, are paid to take on risk. That doesn’t mean we should take bad risks chasing high rewards, but we can’t entirely avoid risk either. But, more importantly, I think it’s important to understand the risks of a position or strategy. There are lots of different options plays out there each with different risk profiles. In addition to the contracts that make up the strategy is the element of time. And it’s easy to get drawn into a strategy that looks safer than it is. That’s not to say it is a bad strategy. There are times when most strategies are good plays. But it’s important to know the real-world risks of a strategy before deploying a significant amount of capital on it.

The Risks of Options

So, before talking about the risks of the trades he proposed, I think it’s worth talking about the risks of an options trade. One cannot define the risks of a trade without knowing the actual risks.

- Price risk is the one risk that most people understand as it’s similar to the stock world. The price of the underlying defines the intrinsic value of a contract. A contact that is in the money (ITM) has inherent value as opposed to an out the money (OTM) contract. Long calls and short puts benefit from a rising price in the underlying while Long puts and short calls benefit from a falling price in the underlying. These risks are estimated in the greeks delta and gamma.

- Time risk simply refers to the amount of time left in the contract. Time value is a component of the extrinsic value of a contract. Time value decreases as expiration approaches and it’s not linear. Rather it is doesn’t really start to move until around 45 days to expiration (DTE) and really is really moving in the last few days of the contract. Time risk is estimated by the greek theta.

- Volatility risk is, in my opinion, the least understood by new traders. But it is also a component of the extrinsic value of a contract and it quantifies the speed of price movement in the underlying. This one is tough because implied volatility (IV) is, well, implied which means it’s tough to measure until after a move has happened. But it’s important when thinking about the probability of a contract being profitable or not. And, to make matters more complicated, the value of that probability is derived from the live prices of the market. Because of that, it’s not entirely predictable. This could be a topic all to itself, but I’ll leave it here as a summary. Volatility risk is estimated by the greek vega.

Strategy: A Long Straddle

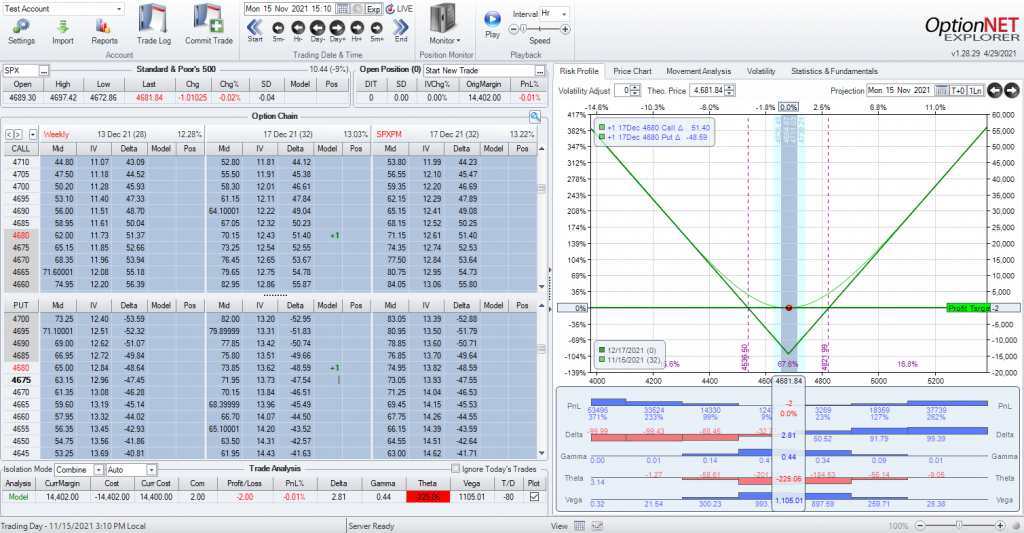

One idea that attracts new traders is the long straddle. In short, a long straddle is an equal number of long calls and long puts at the same strike price and the same expiration. An example of a 32-day long straddle is here:

A 32-day SPX long straddle

As you see, the long straddle makes money if the underlying moves in either direction since you own a long call and a long put. This trade as shown above is what it will look like when the trade is first opened. The graph looks safe..from a price risk point of view. If SPX moves down, the put side makes money, if it moves up, the call side makes money. You have minimized price risk. But the risk of the trade is if SPX stays range-bound and just moves back and forth in a series of normal days. In a long straddle, you don’t just need the price to move, you need it to move a lot in one direction. You need the winning side to make more than the losing side. This is where volatility risk comes into play. You need a large move in one direction. So perhaps you put this on before an event like earnings or you pick an underlying that tends to move a lot anyway. Well, everyone else in the market knows these things too and that will be reflected in the contract prices. If an underlying is reasonably expected to move during the life of the contract, the volatility component of the price of those contracts will be higher. This means your total price of the trade will be higher which, in turn, means you will need an even bigger move to be profitable since you have to make up the money you put into the trade. So you not only need a big move in a particular direction, you need an unexpected big move in a particular direction. And once the event is over, a good amount of that volatility can come out resulting in a “vol crush”. This lowers the price of your options (even the winning side) and can act as a headwind to your profits.

But it doesn’t end there, there’s still time risk. Because both legs of this straddle are long, both are negatively affected by time decay. This reduces the price of both contracts over time and acts as headwind to making money. So, you not only need a large unexpected move in a particular direction, you need it to happen as soon as possible because with each passing day, the hole gets a bit deeper.

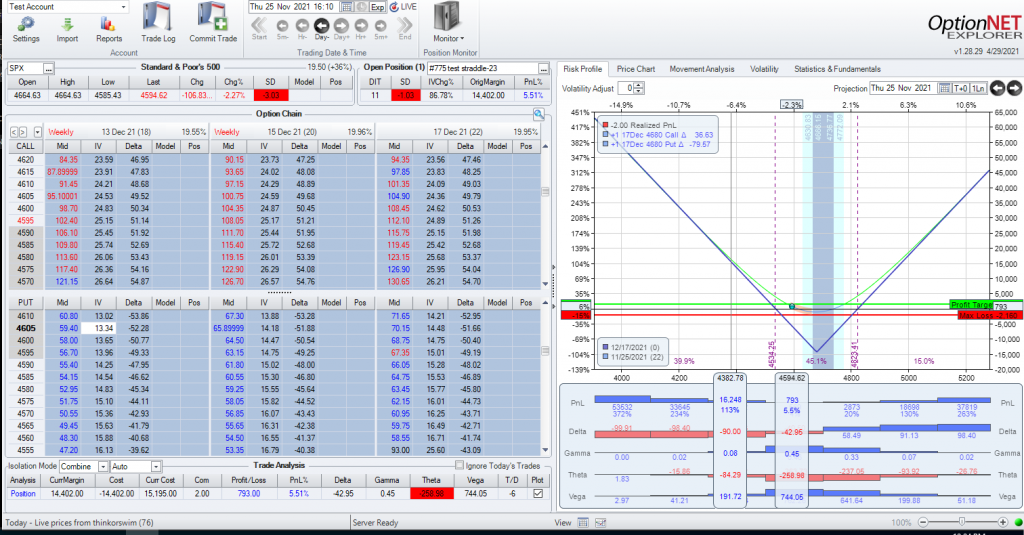

This past week we had a large one-day down move in SPX…106 points or 3 standard deviations. Just the kind of move you would want for a trade like this. Given that we put this trade on Nov 15 (11 days prior) here’s a graph of that same long straddle:

A 32-day straddle after a big move

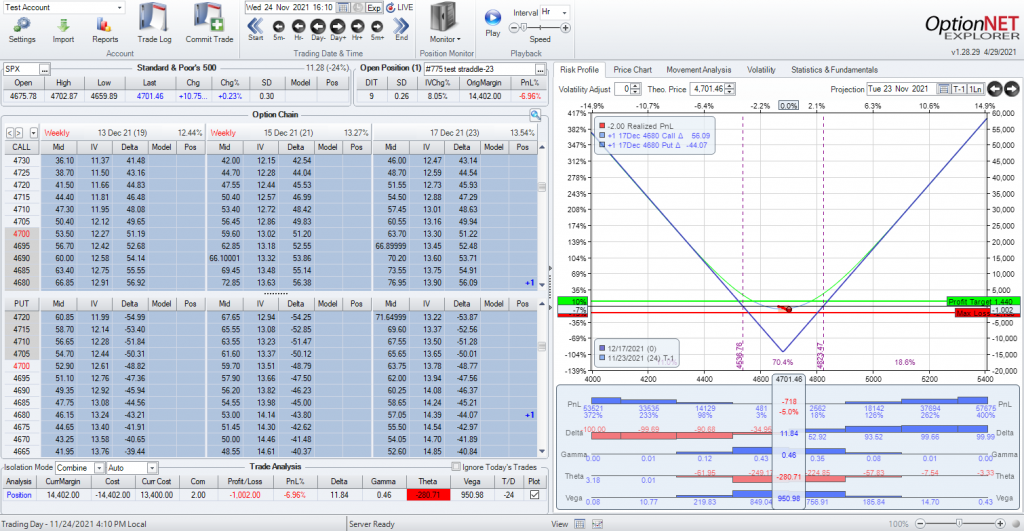

It’s making money to be sure, but it’s up 5.5%. That’s nothing to be mad about however, that’s after a one-day 3 SD move. These kind of moves don’t happen often…this is exactly what this trade needed, and the reward isn’t amazing for the rarity of the event. Part of this is the $200+ dollars of time decay in this trade every day. And what if that big move had not happened? Here’s that trade at the end of the previous trading day:

A 32-day straddle 9 days in with no big move

The trade was down 7% and it took a 3 SD move to get it to 5.5% up. I don’t think it’s a good strategy to count on a 3 SD move to make money on a regular basis. In this case, time and volatility risk can mask the lack of price risk to a new trader.

I’m not saying that a long straddle is a bad trade. If done at the right time, it can be quite profitable. But if your goal is a trade that will generate regular income, the odds of this trade stacked against you.

Strategy: Day Trading Calendars

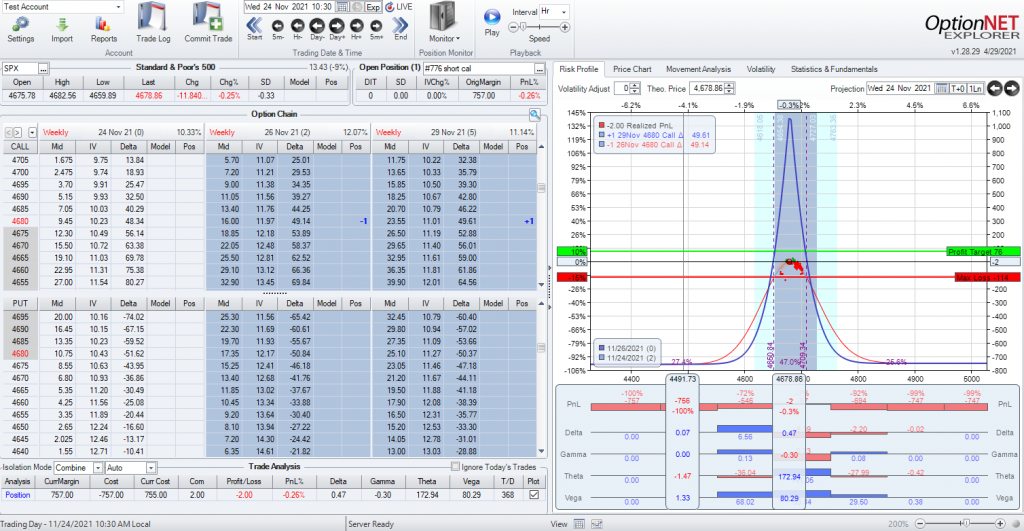

So the next idea that was proposed was very short-term calendars. Now, anyone who follows my trades (which I post every week on this site) knows that calendars are one of my favorite trades. Very quickly, a calendar spread is selling contracts in a near term and buying an equal number of contracts at the same strike later in time. Because time will decay faster on the short contracts (since they have less time) the trade is positive theta so time works in favor of the trade (within a range). The idea was to day-trade calendars and try to skim off regular small profits and avoiding price risk by not holding the position overnight. Again, I see the appeal of this idea. In some ways, it is the opposite of the long straddle. Time is in your favor and not having a large move is also in your favor. You would lose in the case of a large move in one direction within a single day. So what don’t I like about this trade?

A 2-day SPX Calendar

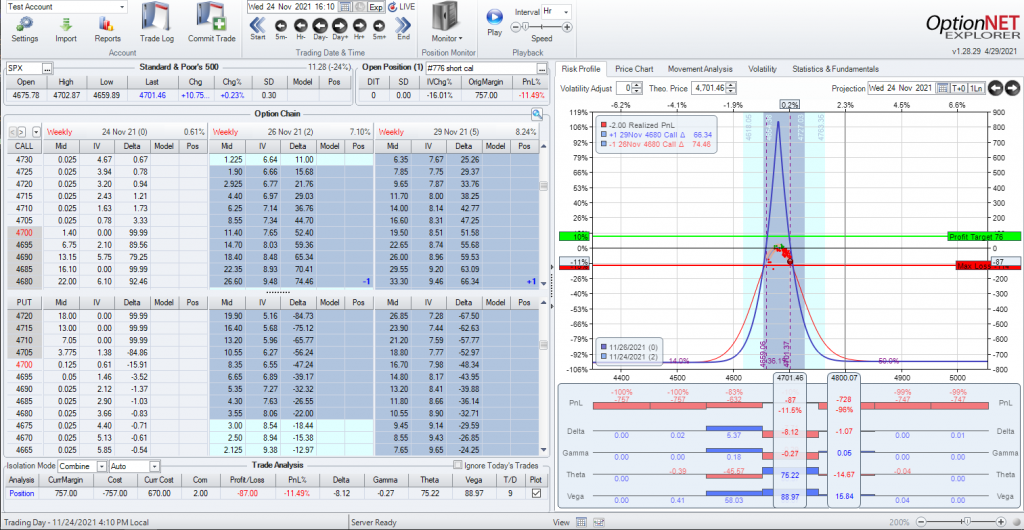

At first glance this trade doesn’t look too bad considering the goal is to be out by the end of the day. Yes, the range is narrow but that’s because the shorts expire in 2 days. Why so short-term? Couldn’t I just go further out in time and get more room? Yes. But then I won’t get much theta decay to actually make money on the trade. If my plan is to day-trade this, I need the trade to be very near expiration to capture enough time decay to make money. That, in turn, gives me a very narrow range. In this case I have about 30 points on each side. But that assumes I stay in for 2 days. The plan here is to be out by market close of the same day. Why does that matter? Let’s look at a very normal market day. This was not a crazy day, in fact, it’s a pretty slow day (+10.75 / 0.2% / 0.3 SD). It’s the kind of day you think would benefit this trade.

…a few hours later

This is the trade at the close of the day. A definitely loser and that’s on a calm day. Why did the trade not do well? While the time and volatility risks are low since the contracts are near expiration and most of the extrinsic value is gone from the contracts, the price risk is a lot worse than you think because of gamma. Gamma estimates the change to delta and in the last week or so of a contract, it gets very significant. So when this trade was first entered, it had a delta of .47 which is very good. But the gamma was –.30. So with a one point move in SPX, delta would change about 64%. And it only gets worse and the up move continued as you see at the end of the day, delta is now -8.12 and that was on a small move. This is one of the reasons I don’t like expiration week and try to avoid it. The price risk near expiration is much higher than it may appear on a graph.

Could this trade work? Of course. But, again, I don’t think it will win with any regularity. Just like the long straddle needed an unusually large move to win, the day-traded calendar needs an unusually small move to win. These trades, in my opinion, are highly speculative and not low risk even though they may appear to be low-risk at first.

So What Can Work?

Every trade has risk and can lose and it’s easy to pick apart a trade idea and show how it won’t work. But I would be remiss if I didn’t give an example of what I consider to be a good balance between risk and reward. This is not to say that this trade is good for everyone. It can lose money and certain moves can hurt it. I also cannot say that this level of risk/reward is right for everyone or anyone in particular. I have no idea of the skill and experience level of anyone reading this blog. But with all that being said, I would like to present a trade that I like in certain market conditions that I think strikes a balance between risk and reward. It may also help calm down some nervousness involving overnight risk. Overnight (and weekend/holiday) risks are real. But if a trade is well constructed, that risk can be managed most of the time.

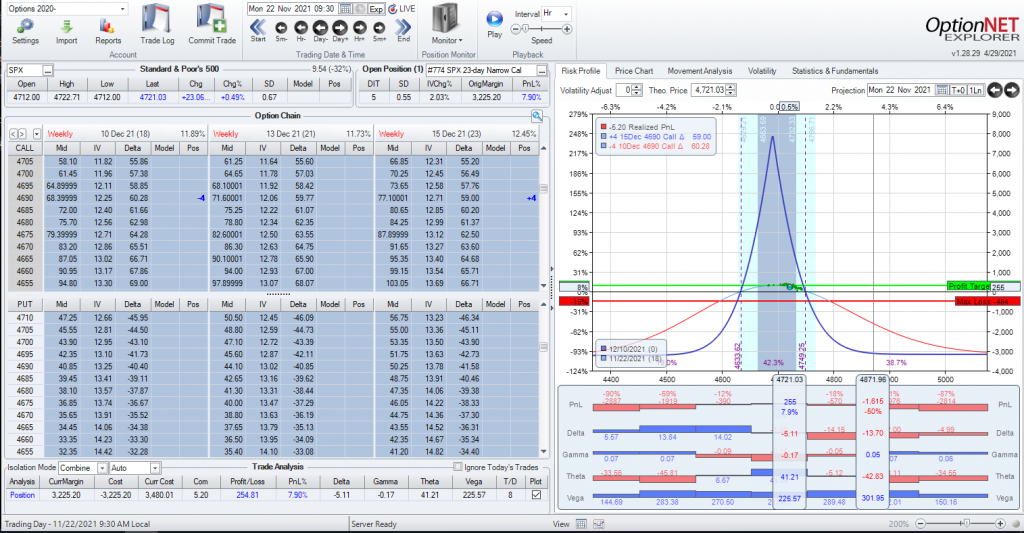

Strategy: A 23-day Narrow Calendar

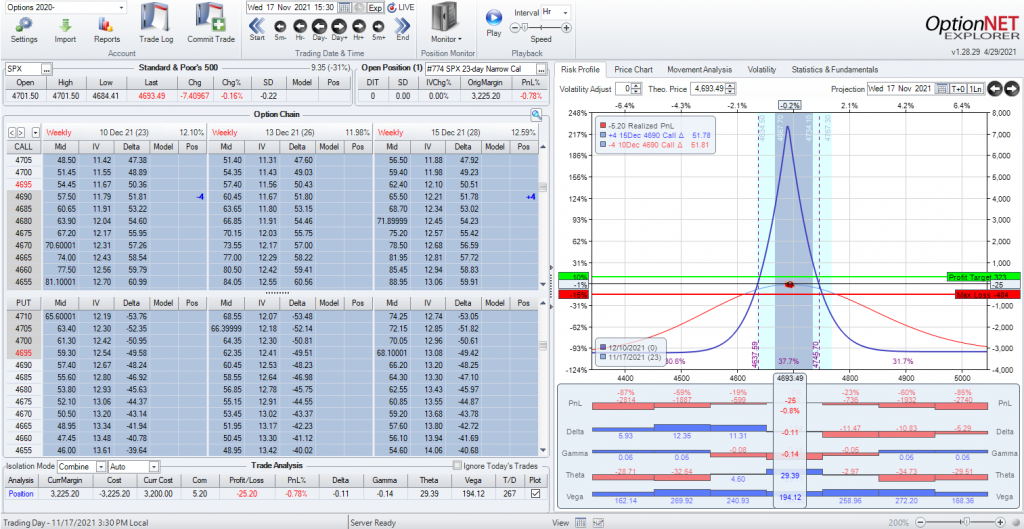

This is real-world example of the last trade I did but I think it works as an example of understanding risk. This is a 23-day Narrow Calendar which is one of my regular trades that I put on most weeks, specifically when the volatility is near the center of the range. Note: Markets can change and as they do, my volatility ranges will change with them. This is based on a range that I’ve been using for the past year and a half, basically since COVID. Because I trade SPX, the VIX is a good estimate of the volatility. This may not be the case for different underlyings so you’ll need to understand the volatility of your particular contracts. But when I put this on VIX was 16.9 which is on the higher side of the middle. This is why I like a narrow calendar. I define a narrow calendar where the longs are less than a week away from the shorts. This is only possible in underlyings that have mid-week expirations, but SPX does. This is the trade when I opened it.

A 23-day Narrow Calendar

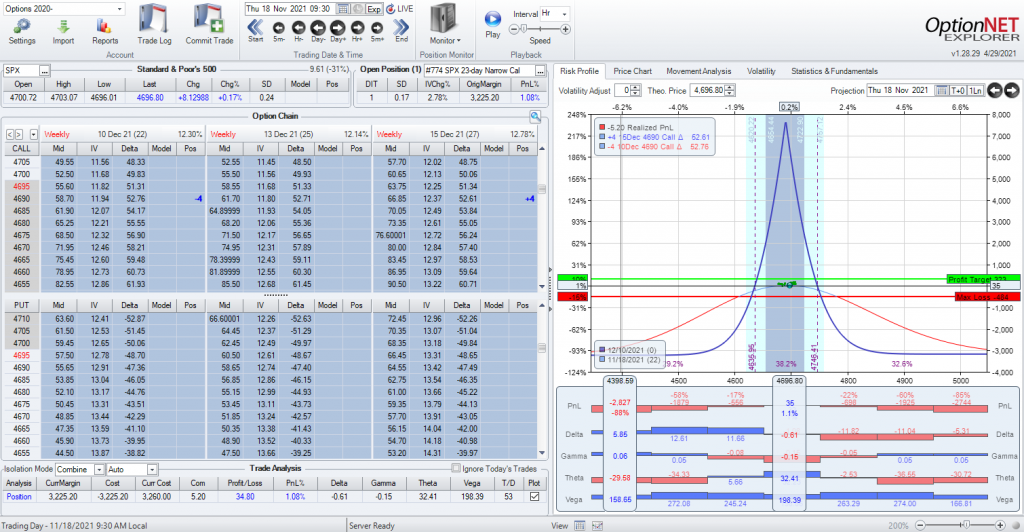

The first thing you should notice is the room on each side. Because the shorts are 23 days away, I have between 1.5 and 2 standard deviations of room. This is based on a single day, but that is relevant since the concern is overnight risk. The odds of open open that will go beyond my range is very low…possible but low. And this is how the open looked the next day.

The next day at the open

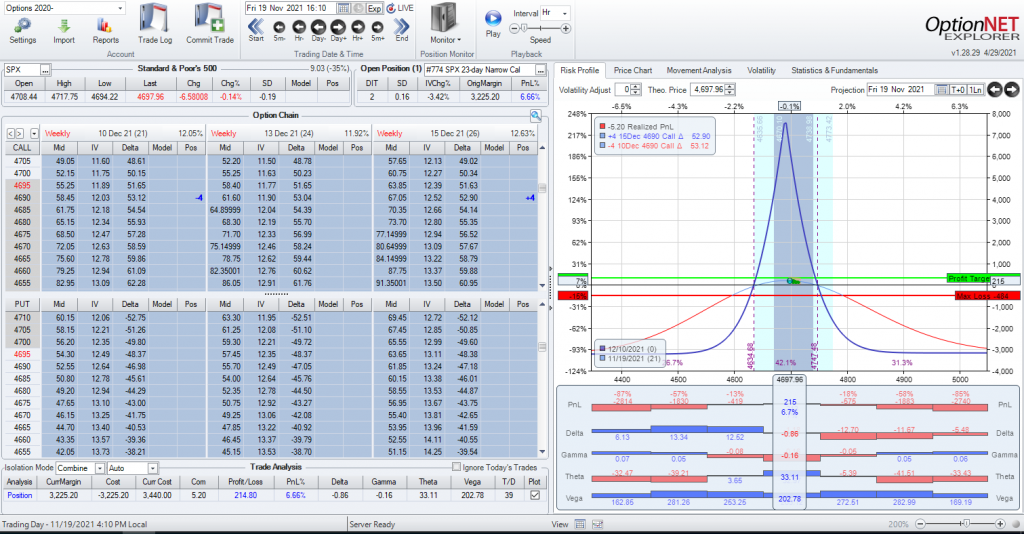

SPX opened up 8 points. Not a problem at all, in fact, I’m up a bit in the trade. For brevity’s sake let’s look at the close of the week (2 days later).

…2 days later

So when the trade went on SPX was at 4693 and 2 full trading days later SPX is at 4698. So the trade is fine. But what about a bigger move? Not a crazy big move, but perhaps more typical market open. Let’s see what happened when I held this over the weekend.

..Monday morning

SPX opened up 23 points (0.5%, 0.67 SD) and the trade is not only fine, but it’s doing very well. In fact, this trade came off around mid-day for about 8.5% (not bad for 5 calendar days). Would it have been doing well had SPX moved 100 points at the open? Probably not. But how often does that happen? Not very often. (Interestingly enough SPX did have a large down move later that week so it’s possible but it’s not common. Maybe a few days a year).

The point of showing this trade is not to promote it or say anyone else should do it but, rather, to help you better understand risk and how it can be managed. This starts with a good trade plan. Had SPX made bigger moves, I had a plan to handle it. In this case, I didn’t need to do anything as the market behaved quite normally. But with any trade, you must be prepared for abnormal things to happen.

My goal in this post is to help demystify risk in the options market. First by identifying the risks and then looking at strategies to face the risks with some examples that look less safe than they are and by showing how I use my understanding of risk to set up a trade. As always, I welcome further discussions on this or other topics relating to options trading. Please reach out to me directly a midway@midwaytrades.com. Who knows? Maybe you will inspire a new blog post.

This content is free to use and copy with attribution under a creative commons license.