Why I Avoid Expiration Week

Originally posted on August 11, 2020

As I interact with options traders (mostly online), I see the topic of expiration come up quite a bit. I see lots of questions about what happens when options expire, especially in the money options. While I think it’s good to understand the terms and conditions of options contracts, I do not believe it’s usually worth putting oneself in the position where expiration is going to be a problem. In fact, I not only avoid expiration day I avoid expiration week and will explain why in this post.

Exceptions to the Rule

Before getting into why I don’t like expiration week, let me say that much of this has to do with how I trade. I’m not saying that every strategy, or even every successful strategy should never go to expiration. There are perfectly good strategies that expect to take contracts to expiration. One such strategy is known as the Wheel or I’ve seen it called Laddering. The idea is that you sell cash secured puts on shares you wouldn’t mind owning. Then if you get assigned, you sell covered calls against those shares at a price you already like. While this isn’t the way I trade, it’s a perfectly good options + stock strategy. But notice, I said “+ stock”. This strategy explicitly plans to own stock at some point in time. If a trading plan includes this, then going all the way to expiration is perfectly acceptable and, perhaps, even desirable.

Another example could be a vertical spread that is very far in the correct direction that going to expiration yields maximum profit and the risk of losing is very low. In this scenario, I would prefer a credit spread so that everything expires worthless and there is no assignment mess but it can work with a debit spread. While this carries a bit more risk than the wheel, it’s reasonable under these conditions to go to expiration.

There may be other exceptions to my rule but these are two off the top of my head. But now I’ll talk about why I don’t like expiration week.

What I Don’t Like About Expiration Week

If you’ve followed my trading videos at all, you know I like to trade non-directional spreads on large indexes (usually SPX). One of the many reasons I like doing this is that I don’t like picking direction and I don’t want shares (SPX is cash settled since there are no shares unlike SPY). There are occasions when I may trade an underlying that is share settled but, in any case, I have no desire for shares of stock in my options account. It’s just not part of my strategy. Because of this, expiration day and even expiration week cause more headaches than they are worth.

High Delta and Gamma

The main reason I don’t like expiration week with the types of trades I put on, it’s almost impossible to stay non-directional which is one of the main goals of my trading. I trade mostly calendars and butterflies which both have expiration graphs that look like tents. In fact, in my videos you’ll sometimes hear me refer to the tent of the trade. But for most of the trade, the T0 curve, which reflects today rather than expiration looks nothing like the tent. See an example below:

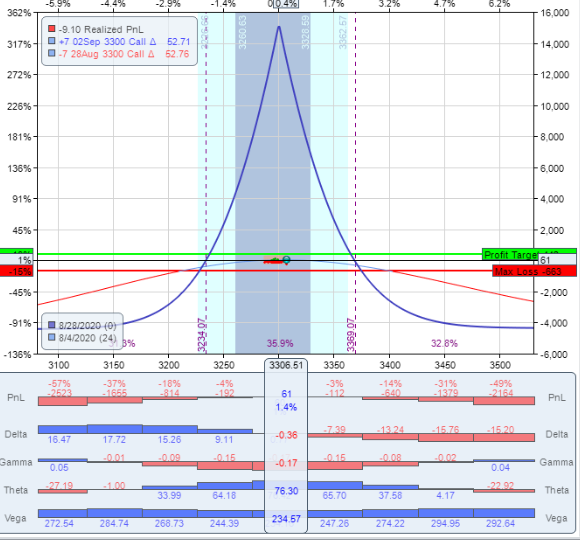

A 24-day Calendar on day 1

This is an example of a 24-day calendar which is a typical trade I’ve been doing recently. The shorts are 24 days away from expiration while the longs are 5 days away from the shorts. The dark blue “tent” is the expiration graph the light blue arch is the T0 line which represents the risk today. Note the difference between the two risk lines. As the trade gets closer to expiration day, the two lines will converge, slowly at first but very rapidly in the last few days. Note the slope of the T0 curve. It’s quite flat and manageable and I would consider this trade reasonably non-directional. And the Delta and Gamma values reflect this as they are both very low. As the underlying moves in either direction, the effect on the position is not very much, at least until you get outside the tend at which time the slope starts to get steeper. However I have a reasonable amount of time to manage the price risk as the tent covers about 2 standard deviations for 1 day. The odds of this trade staying in my tent in one day is around 94%. Not guaranteed to be sure but pretty good odds and even if it does go outside the tent in a day, the odds of not getting a chance to manage the trade is even lower. This is a pretty manageable trade, in my opinion. calendar_day20.png Now let’s look at the first day of expiration week:

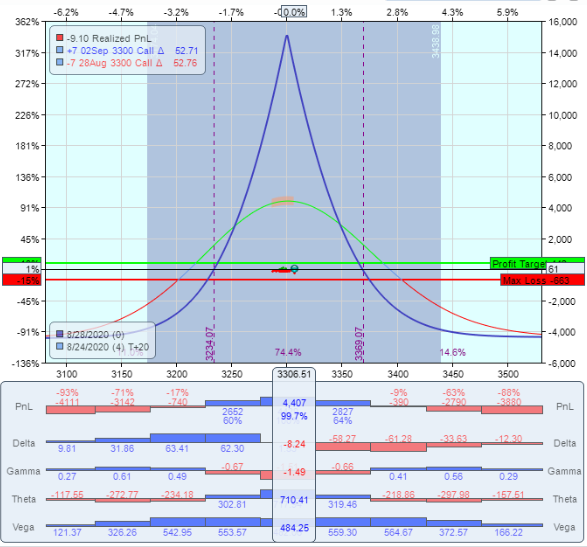

A 24-day calendar on day 20

So this is a theoretical view of that same calendar on day 20 (the Monday of expiration week). Now the change in the T0 line is much more apparent. On the one hand, the profit potential if the underlying stays in the tent is very good. At the center I can double my money. But look at the slope of that curve and the corresponding delta values. Delta gets very big, very quickly and moving much to either side of center can get this trade into trouble very quickly. This, to me, is no longer a non-directional trade once it moves even a few points from the strikes of the contracts. While the potential reward is great, the price risk is too high for me. Take a look on Thursday of expiration week:

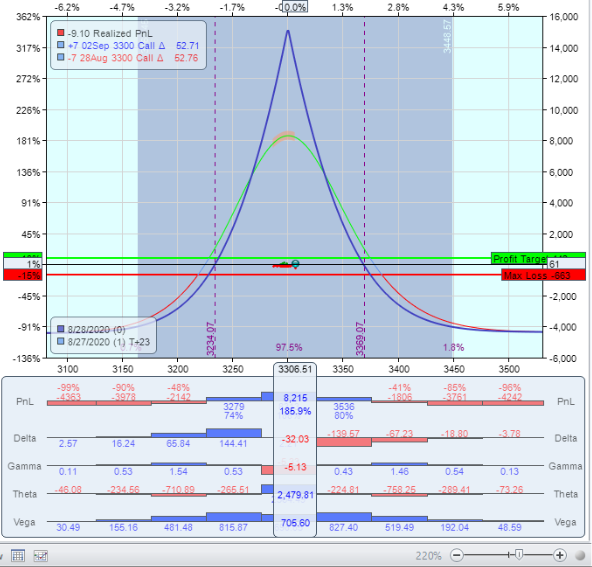

A 24-day calendar 1 day to expiration

Now the two graphs are almost aligned which makes sense since expiration is 1 day away. But looks that the Delta values as you get away from the strikes. They get into triple digits very quickly. But also compare the corresponding Gamma values on the 3 charts. The high Delta change rate is driven by Gamma and Gamma is exploding during expiration week. This is why I refer to expiration week as “Gamma Week” because Gamma is driving the risk. Is there a big profit potential? Of course. But it all can vanish very quickly with a decent move and we still have another day in this trade before expiration.

Perhaps your thinking, well that’s just a calendar, what about a wide Iron Condor? Sure, you may get more room on a high-probability Iron Condor. But as expiration approaches, you run the risk of taking a max loss on the trade and the wider you make your Iron Condor the less credit received and the lower the reward for the risk being taken. Can they work? Sure. But you need the stomach for the end of the ride. For me, the risk/reward of wide Iron Condors is not attractive.

Assignment Is a Hassle

Just my opinion here, but dealing with assignment scenarios when I do not have the goal of buying/selling the stock is just not worth the hassle. As you saw in the above example, the risk/reward gets crazy but in addition to that, there can be assignment fees which can cut into the profits as well as tying up capital to squeeze out those last few dollars out of a trade. Taking all of that into considering, I’d just rather avoid it altogether.

Avoiding Assignment

Fortunately, avoiding assignment is relatively easy. Assuming the underlying is settled in shares, you can avoid assignment in almost all cases by doing the following:

Close Before Expiration

This is the most obvious one. Just don’t be there when expiration happens. Take most of your profit and move on to the next trade. If your position isn’t open, you can’t be assigned.

Be Aware of Dividends

While most underlyings are “American Style” which means they can be assigned at anytime before expiration, this rarely happens. The #1 reason this does happen is dividends. If the dividend is worth near or more than the extrinsic value on your short calls, there’s a good chance the shorts will get exercised and the shares will be called away at or near the ex-div date. The good news is that the dividend amount as well as the ex-div date are public knowledge, so with some planning, it’s easy to avoid this situation as well. Don’t have a short position on if there’s a reasonable chance someone would want to buy the shares to collect the dividend.

There are some rare cases that you can’t always anticipate. The only time I’ve had shares called away early was due to an acquisition. I sold some calls against some shares I owned and the company was bought by a larger competitor at a good premium. My shares were called away the very next day (it was announced after the market closed). In cases like these, there may not be much you can do to avoid early assignment. But fortunately, this is very rare.

What Do You Think?

So, this is why I don’t like being even close to expiration. It just doesn’t fit my style of trading. That doesn’t mean it’s wrong on all occasions, but I think it’s important to understand what can happen as trades enter Gamma Week. I see traders worry about what will happen to their trade if all or part of their trade expires in the money all the time. I agree it can be confusing, especially to newer traders. So unless your trading plan includes assignments, just avoid it. Thankfully, avoiding the various expiration scenarios is quite easy to do.

So, that’s my take. As usual I’m always interested to hear what my audience thinks. This is a place for learning and discussion options. So feel free to ask questions, make constructive comments, or start a discussion.

Until next time….Good Trading!

This content is free to use and copy with attribution under a creative commons license.