Mid Year Review: 2024

What a Difference 1 Month Can Make

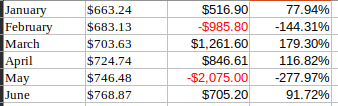

This year started out quite well. Then May happened where I really didn't manage things very well and ... well here are the results:

So January was fine. February wasn't great but off months happen. March and April were very good...then May. May was so bad it blew away everything. That can happen when traders mismanage trades. See my review video for May 31, 2024 entitled “May, May Go Away” for all the details, but for the purposed of this summary, the results speak for themselves.

So What Happened?

As many traders will know, all it takes is one bad one to mess things up and that's exactly what happened in May. I let one Narrow Calendar get out of control and took a 50% loss on it. I did have 2 other losses so the month wasn't great, but that's the one that made the big difference. My trading plan is based on the idea of winning most of the time and keeping losers under control. I didn't do that in May and that was the result.

Is it catastrophic? No. I had built up some decent profits earlier in the year and my account is fine. As I've said from the start, this is a learning account and that's what I did...I had to re-learn discipline on bad trades. Losses happen. They are a part of the business. It's ok to have a loss take out 1 or maybe 2 wins. But it can't wipe out month or more. That is not how to grow and account. So I have reset for the 2nd half and am working to get back to the discipline that got me 30% last year. I know I can do it, I just have to execute.

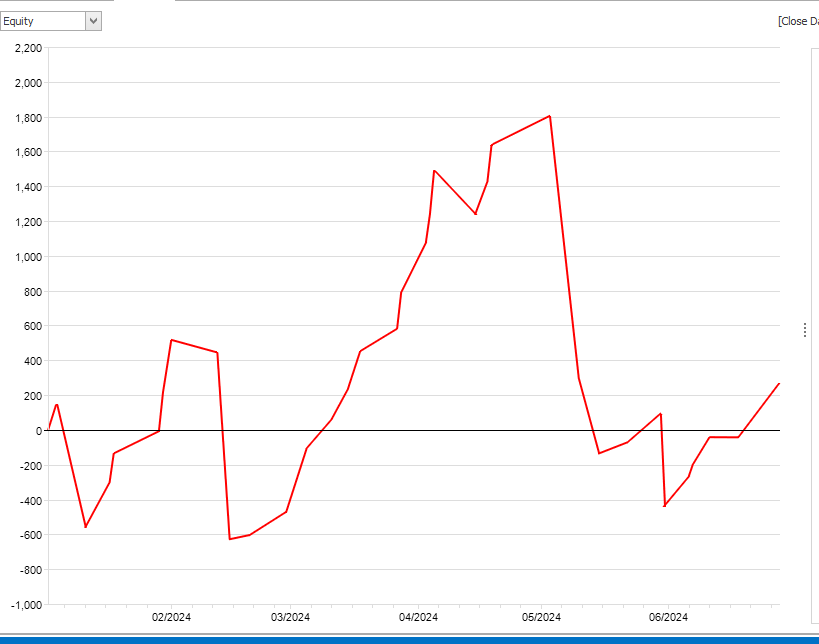

To see how February and, especially, May affected my account, just look here:

I fell into the red a couple of times, but managed to end the first half above water. Not by much, but given those 2 bad months, I'll take it.

Visualizations

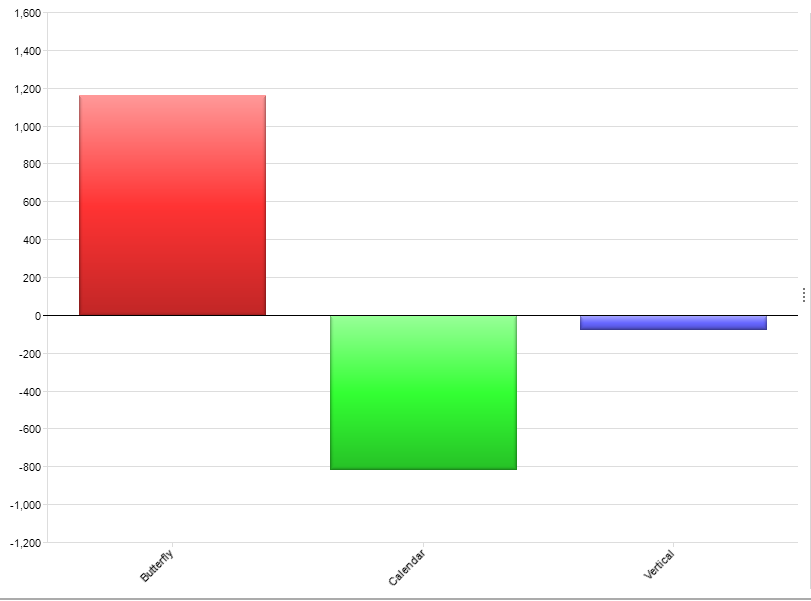

Here are the usual stats and this time there is a lot of skew that would lead one to some false conclusions. This is due to the small number of bad trades, especially the 50% loss above. Here is the first example: strategies:

This would leave one to believe that calendars were not a good trade. That is far from true. But that one bad trade accounts for the entire overall loss. So I would argue that calendars did work overall. I only did 2 verticals so there's not enough of a sample to say anything useful. The data is the data, but sometimes context is needed when trying to learn from it.

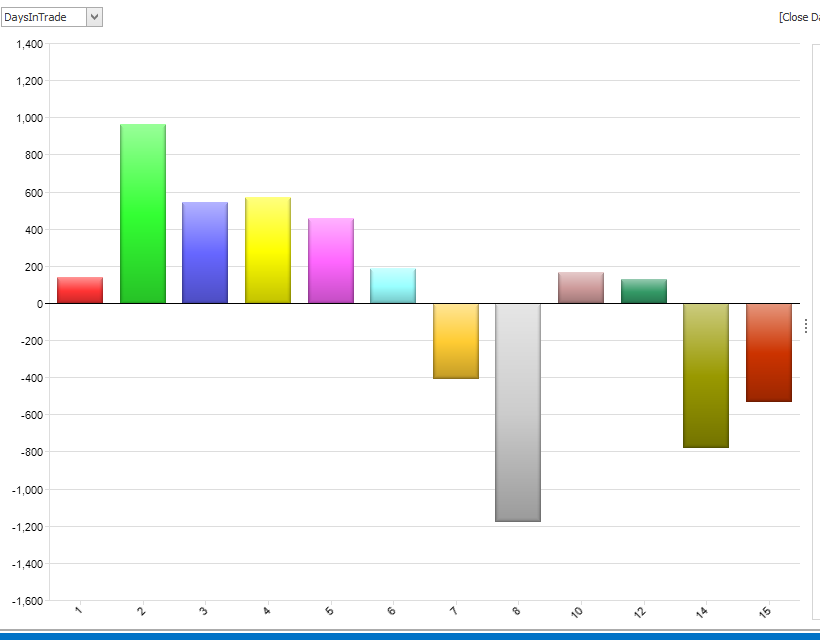

Another place where there is some skew is in days in trade. It generally follows the normal pattern (the less time in a trade, the better) but 2 trades skewed it a bit:

Here the 8 and 15 DIT are skewed by my 2 biggest losses. It's still good data to know, but I don't think the time in trade was the issue. But I can still say that, in general, the less time I'm in a trade, the better. This is because the longer I'm in a trade, the higher the chance of adjustments. That doesn't mean adjusting is bad, but that once I start adjusting, I need to be extra vigilant about that trade and keep it on a shorter leash. Bigger losses happen for me when I over-adjust. On the bad trade in Feb, I adjusted 6 times. That's too much. On the bad one in May, it wasn't too many adjustments, I just mismanaged it in other ways and needed to take it off earlier.

Closing Thoughts

I'm not going to dwell too much on the negative. It wasn't all bad. I had a 79% win rate which is on the upper end of my range so I managed most trades just fine. The key is to prevent the big losses that can wreck things. I thought after last year's success I was really good at that. It was time to re-learn my Pets vs Cattle lesson. If I can do that, then I can salvage something good out of this year. Onward!

This content is free to use and copy with attribution under a creative commons license.