The Poor Man's Covered Call

Originally posted on December 6, 2020

When folks first get into options trading, one of the most popular options strategies out there for beginners is the covered call. The idea is that you own 100 shares of stock and you sell a call against the shares (1 for every 100 shares owned). The idea is that you get paid to wait for the stock to go up and you get some downside protection if the stock goes down a bit since the call will lose value allowing you to potentially keep more of the premium. The primary risk of this trade is exactly the same as owning the stock. There is some opportunity risk if the stock goes up past the strike of the call you won’t profit much beyond the strike price. But in this case you won’t lose money in absolute terms which makes it a low stress trade. The shares can be called away but the trader gets to set the price so as long as that price is a good one for the trader, it’s not a bad outcome. Ideally, there will be an opportunity to sell multiple calls against the shares over time thus lowering the cost basis of the shares, thus adding to the potential profit of the position. Some folks take this further and pair this strategy with cash secured puts to acquire shares as well. This is commonly called “the wheel” and is a topic of another day.

So, once a trader is comfortable with the covered call, the next question becomes, “Can I do this without owning the shares?”. And the answer is yes. This is done by creating a long diagonal spread. But not just any long diagonal spread, rather one that mimics the risk profile and reward of a covered call. This is known as a “Poor Man’s Covered Call” (PMCC). The “poor man” idea is that it can be done for less money than a full covered call. How much less will depend on how closely the trader wants it to behave like a regular covered call. This is done by substituting 100 shares of stock with a deep in the money long call. This call is usually far out in time. Then you can sell a call against each long call you purchased nearer term just like you would in a standard covered call. This creates a long diagonal call spread but if done in this manner, the risk profile can greatly resemble the risk profile of a covered call.

My Approach to the PMCC

Because this is a popular trade with new traders, I see questions about it on options forums all the time. I’ve answered the question so many times that I thought it was worth doing a longer form explanation here on the site. In the spirit of transparency, I will state that I don’t trade this all the time. It’s not one of my regular monthly trades. But it is a trade I will do occasionally. I’d estimate in 2020, I did this trade about 6 times. But I think my approach to it as a solid one. If you disagree or have other ideas, feel free to comment below. I’m always open to hear other ideas on trading. When I have traded it, it has worked out well so I think the approach is reasonable. Of course, there are no guarantees in this business so if you learning any new trade you should start small (or even on paper) to control your risk while learning it and scale up over time as you become more comfortable. These are just my guidelines with respect to this trade that constitute my trade plan.

THE SETUP

Every trade plan starts with a setup. There are many different ways to start this trade each with advantages and disadvantages. To me, the important concept of the setup of a PMCC is to get a very similar risk profile while still putting up less overall risk. There is no perfect setup. Every setup has trade-offs. The primary trade-off of the setup of a PMCC is cost vs risk profile. The closer the risk profile is to a real covered call, the more the trade will cost. This makes sense because if it were possible to get a 100% match on the risk profile for significantly less risk, why would anyone do a real covered call?

That being said, my setup is pretty simple. I look to buy my calls about 6-9 months out at about an .80 delta. Is this perfect? Of course not. But I think it’s a good balance of trade risk vs risk profile compared to a covered call. The further out in time you go, the more opportunities you have to sell calls multiple times against you longs, but the higher the cost of the long calls. The deeper in the money you go, the more it will resemble the risk profile of a covered call, but the cost will be higher.

Once I have selected my longs, I will sell my shorts around 30 days out around a .30 delta. This is where you have some flexibility as well. If you are used to selling covered calls, you can sell the same calls you would sell against your stock. If you prefer to nearer term options, that’s fine. If you like to sell a different delta, that’s fine too. It’s always a good idea to look at the model in your broker’s platform and ensure that you are comfortable with the risk profile and the total risk of the trade. You most you can lose is the debit you pay for the trade (unless you adjust, then it will change by the amount of the adjustment).

ADJUSTMENTS

In the ideal scenario, there would be no adjustments. You put this trade on and simply continually sell calls against your longs until the long is ready to expire, then you close the entire position and make a nice profit both from the longs and the multiple shorts over time. But the market does not always cooperate, so it is important to have a trading plan that includes what you will do in every situation. You don’t want to be in a position where you are looking for help while an active trade is moving against you and you don’t know what to do. All of my adjustments (short of taking off the entire trade) involve only the shorts. I do not like to adjust the longs. In my opinion, there is a fine line between adjusting an existing trade and closing a trade and opening a new one. To me, rolling the longs is creating a new trade. Others may certainly disagree, of course. But it’s very easy in trading to try to fool ourselves into not taking a loss by endlessly adjusting a position. Every trader does this at some point, myself included. I think it’s important to look at trades clearly and honestly. Do not be afraid of taking losses. Everyone takes losses at some point. They key is to manage them properly and endless adjusting is a very easy way to allow a bad trade to get out of control. Again, I speak from personal experience here.

My first adjustment is based on the value of the shorts. There is a temptation to want the shorts to expire worthless thereby keeping all of the premium. Most of the time I think this is a bad idea. I think it’s more important to look at the reward vs the risk of the position when deciding when to take off (and potentially re-deploy) the shorts. My rule of thumb is when the short has lost 75-80% of the premium paid for them, it’s time to close them and potentially roll them out in time for another run. Trying to squeeze out that last bit of extrinsic value isn’t worth the risk to me. Another condition that would cause me to close the shorts is expiration week. I have no desire to hold the shorts open later than 2 days to expiration. Most of the time, I will close them before this. I have no desire to go to expiration, the risk is too much for the last bit of extrinsic value left in the contracts. Finally, if the underlying stock has a dividend, I would close the short before the extrinsic value of the contracts meets the amount of the dividend. This is to avoid early exercise of my short calls. This is especially true close to the ex-div date, but I would follow this at any time. My goal is to avoid the exercise of my shorts and following these guidelines will do that the vast majority of the time.

My second adjustment condition is based on the share price. If the underlying stock price drops, the value of the short calls will drop with it. However, there will come a time when the short is no longer providing any more protection against the downside. At this point, I’m not interested in having this short on my trade and I’d prefer to roll it down (and possibly out in time) to get more downside protection and to bank a bit of profit on my shorts in the process. I will show an example of this later in this post. This isn’t free. In exchange for more downside protection and the banked profit, I will give up more potential upside profit because I am rolling down. If the stock rebounds past my short strike, the amount I can participate in the price gain will eventually stop because of the short.

CLOSING THE TRADE

What if the price goes up beyond the strikes of the shorts? This means the shorts are now in the money and are probably worth more than the premium received due to intrinsic value. This is where I see the most questions in options forums. Usually the question is about the shorts getting exercised. As I’ve already stated it is never my goal for my shorts to get exercised as that is not why I am in this particular trade. So what’s a trader to do? You can certainly wait and see if the stock comes back down. Maybe it was just a temporary spike and doing nothing is the right answer. But be cautious here. I would only do this if I had at least 50% of the time left on my shorts and the breach isn’t very far above my shorts. It’s OK to wait a bit and see if things move back in the preferred direction, but hope is not a strategy. At some point, you may need to act. My next guideline is to simply take the entire trade off for a net profit. If the shorts are in the money, you will lose by closing the shorts, but you should have gained more with the longs due to the delta difference between them (remember I am buying around a .80 delta vs selling around a .30 delta). So the entire trade should be profitable. Maybe it wasn’t the profit I wanted when I set it up, but it’s a profit and there’s nothing wrong with taking it. How often does a trade move against you and you still make money? There’s no law that I can’t take a trade off now, wait a bit for things to settle down, then put a new trade on later and try again if my thesis on the underlying is still reasonable.

And let’s never forget the best reason to close a trade: You reached your profit target. Every trade plan should have a specific profit target. This can be a dollar amount or a percentage of the risk, but it is a critical part of the plan. The biggest enemy here is greed. If your plan is to get 20% on a given trade, and you can close it for 20%, close the trade. Getting greedy is a great way to lose. Now, if you’re doing so well that you can bank your profit target by only taking off part of the trade and you want to play with the rest, that can be done. Just always keep in mind that whenever your trade is on, you have risk. The primary job of a trader is risk management. Do not add risk back to the trade when you do this. The whole point of doing this is to realize your profit and continue with significantly reduced risk, ideally so little that if you lost it, you would still make money overall on the trade. The bottom line here is that every trade plan should have a specific profit target and it should be respected. When the market gives you what you ask for, take it.

Finally, just like every trade plan needs a profit target, it also needs a maximum loss which should also be shown respect. In this particular trade, the biggest risk is the stock dropping and approaching (or even crossing) the strike of the longs. There will come a point when rolling the shorts for more credit makes the trade ultimately unprofitable. If either of these things happen, it’s time to close the trade for a loss and move on. This is probably the hardest part of trading, but it must be done. Even though this trade should work the majority of the time, it can lose and you must be prepared for that possibility.

A Real-World Example

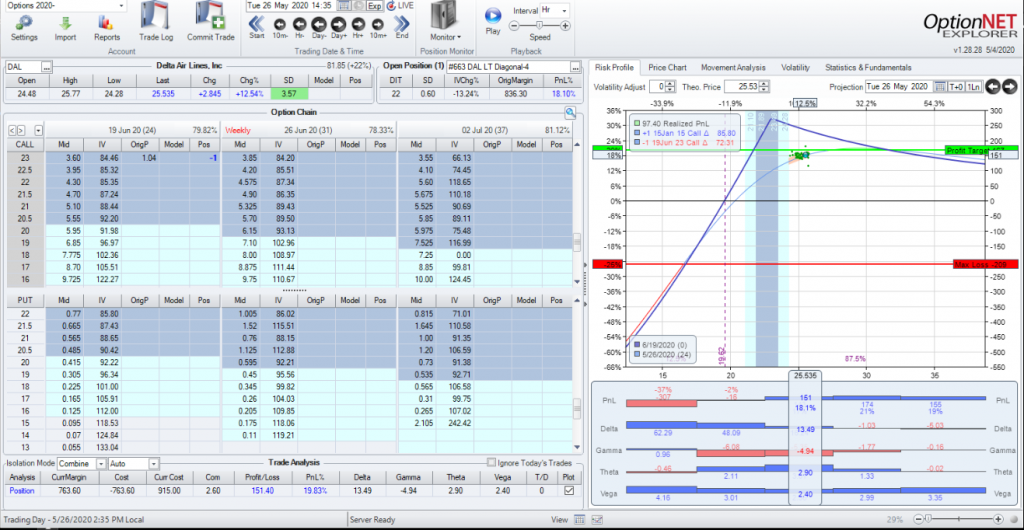

So I’ve gone over the theory of this trade as well as my approach to it, but there’s nothing like seeing it in the real world. This is one example of a trade I did earlier this year in Delta Airlines (DAL). I did several PMMCs on this stock in 2020 with some reasonable success. But I think this particular trade demonstrates some of the concepts I discussed earlier.

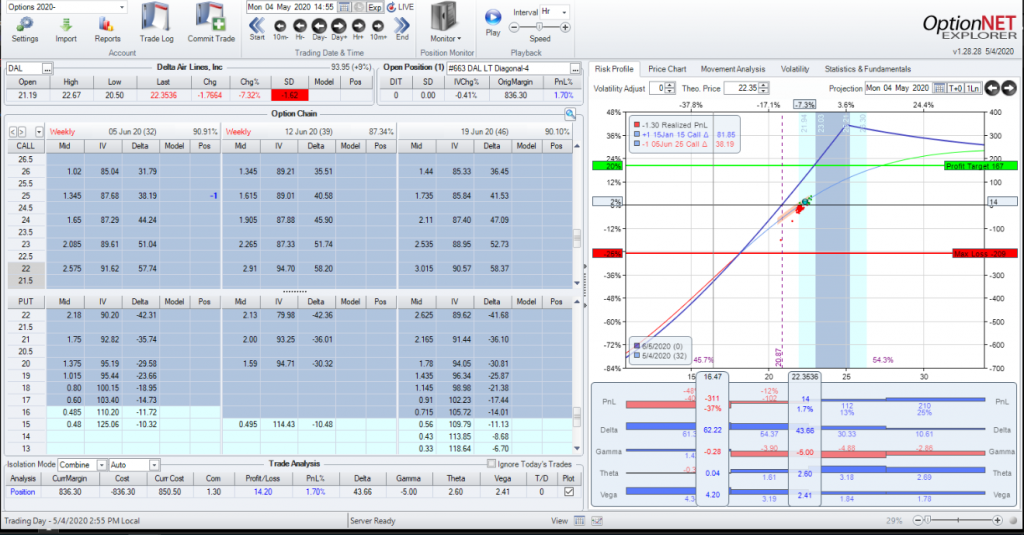

So I opened this trade on May 4, 2020. DAL was trading at about $22.35 at the time I opened the position. I bought a Jan 15, 2021 Call (about 7 months out) at the $15 strike which had a delta of 81.85. I then sold a June 5, 2020 (about 32 days out) call at the $25 strike price which had a delta of about 38. My profit target was 20% and my max loss was 25%. The rationale behind this trade was that DAL pulled back about 7% that day (this was during the pandemic) so my forecast was that it would rebound a bit from that. I paid a net debit of $836.30 for the trade so the trade was a a reasonable discount to owning 100 shares of DAL. This is the risk profile at the start of the trade.

Initial setup of DAL PMCC

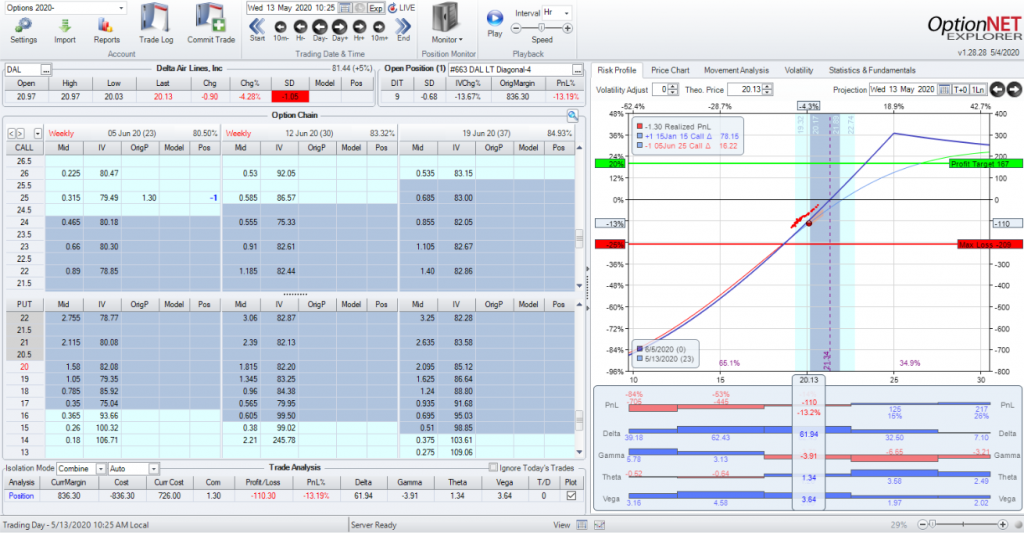

So 9 days later, on May 13, the stock had dropped to $20.13 and the trade is down $110 or about 13%.

Day 9 of the PMCC..not good

Not what I wanted, of course. But the good news is that my short for which I collected $1.30 of premium was not trading for about $.30 or about a 75% discount. This meets both criteria for my guidelines for rolling my short. In this case, I choose to roll down to a $23 strike and out 2 weeks to June 19 for a net credit of $.74 (bought the short back for $.30, sold the new one for $1.04).

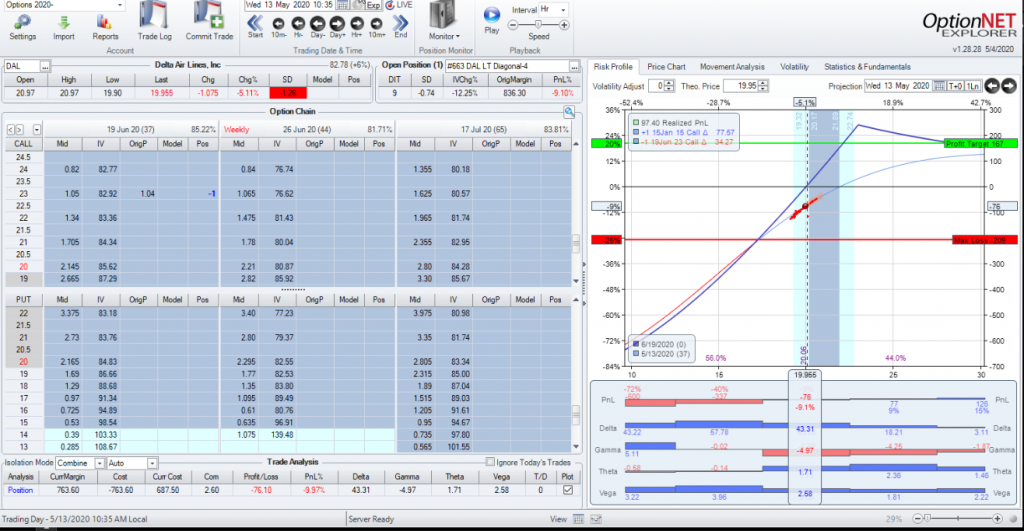

Adjustment

The result of this roll is that I have more downside room and I banked a bit more credit, but my upside is more capped since I rolled down. That green 20% target line is going to be tougher to reach. Because of this, I’m willing to take a bit less should the market give it to me. It’s possible I could end up rolling again which could put 20% back in play, but for now, I’d be happy with perhaps 15% depending on what happens.

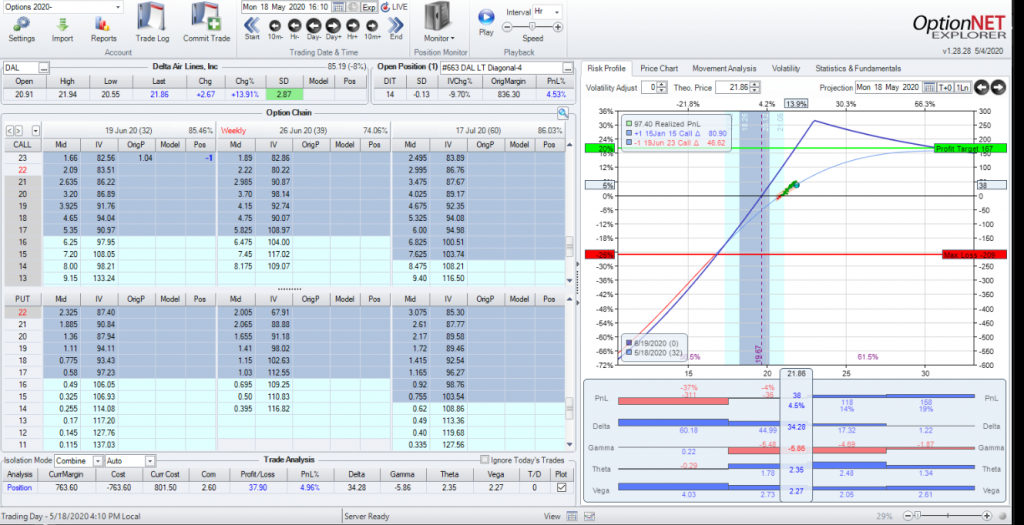

Not much happens the rest of that week, but the following Monday, DAL makes a nice gain, nearly 14% so the trade is at least starting to make money again.

That looks better

As you can see, my short has gained value (now trading at $1.66) which hurts the trade but the larger delta of my long has made the overall trade profitable.

A little over a week later, DAL popped again now trading at $25.35. My short has jumped to $3.60 but, again, my long has pushed the trade up even more.

Now that’s more like it

At this point, I could try and wait it out and get the full 20%, but I go ahead and take a bit less. This is still a nice profit and I’m glad to take it. I don’t want to roll the short because getting a net credit at this price would be next to impossible (I’d have to go way too far in the future which breaks the trade structure) and I don’t want to roll for a net debit. So, I simply take the trade off for a nice albeit slightly lower profit than my target.

Conclusion

This is how I approach the PMCC. It is certainly not the only approach, but I think it’s a good place to start if you are new to the trade. You may make your own adjustments to my trade plan that that’s fine. What is far more important is that you have a detailed trade plan for this and every trade you open. This plan should have all of the elements I have described here: a setup, a profit target, a maximum loss, and adjustments for each direction. Once you have this, trading is more a matter of execution. That doesn’t mean every trade will work (I have lost on this trade with this plan) but you should be able to control the losses and be overall profitable with practice.

If you have questions, comments, suggestions, please feel free to reach out. I really like talking options trading so feel free to comment below or you can reach out privately via email at midwaytrades@midwaytrades.com.

Good Trading!

This content is free to use and copy with attribution under a creative commons license.