The Greeks Around Big Events

I firmly believe that understanding options greeks is an important element in risk management which is the heart of this business. The greeks give traders a way to quantify the different aspects of risk for a given position as well as an entire portfolio. For those unfamiliar with the greeks, I suggest watching my Options Fundamentals video series to being your process of understanding them.

But it is important to remember exactly what the greeks actually are: variables in a mathematical pricing model. This model is theoretical and therefore cannot always represent the real live markets. In the real world prices are set by buyers and sellers in an auction style market. The participants are real people (and algorithms written by real people) and these participants live in the real world and know about real events that happen in the world. While we can't predict all news and events, many events are known such as earnings, dividends, as well as important government reports that affect a given stock and Fed actions like FOMC meetings. As these events approach, some of the greeks can get skewed and looking at them alone may not reflect the real world. This is especially true of theta (time decay). I'm sure most of us have seen the standard theta charts that show as time approaches expiration, theta increases meaning that the time component of the extrinsic value of a contract decays faster. Traders (especially sellers) take advantage of this to make money. But when a major event is close by, contracts that expire shortly after the event will behave differently due to the uncertainly of the event. We don't know exactly what earnings will be or what the Fed will do with interest rates, etc. Because of this the time decay of these contracts will not accelerate as expected. Whether you want to think of this as theta slowing down or implied volatility muting the effects, it doesn't really matter. What matters is that if you are an options seller of a contract after a big event, you can't expect the same level of decay as if the event wasn't occurring. And this makes sense if you think about it: Why should you expect to get paid the same for an event about which everyone knows? The market makers aren't going to let you out of a contract close to an event for the same price. As I stated earlier, this is a risk management business. We traders get paid to take risks. And if an event is seen as a significant risk, we should not expect to be paid the same as if the event wasn't going to happen.

Real World Examples

It wouldn't be a Midway blog without real world examples. In the second week of December of 2023, there were 2 major events on consecutive days. On Tuesday the 12th there was a CPI (inflation) report and on Wednesday the 13th there was an FOMC announcement on interest rates. Both of these events can affect the prices of stocks. As I entered trades the week before these events, my goal was to see if I could get anything out of a couple of trades before the events occurred the following week. I was not expecting to get a full profit, but I was just trying to get something. On one trade, I did get a small profit, on another I took a small loss. Let's take a look at the trades and the greeks of the trades.

An SPX 11-day Double Calender

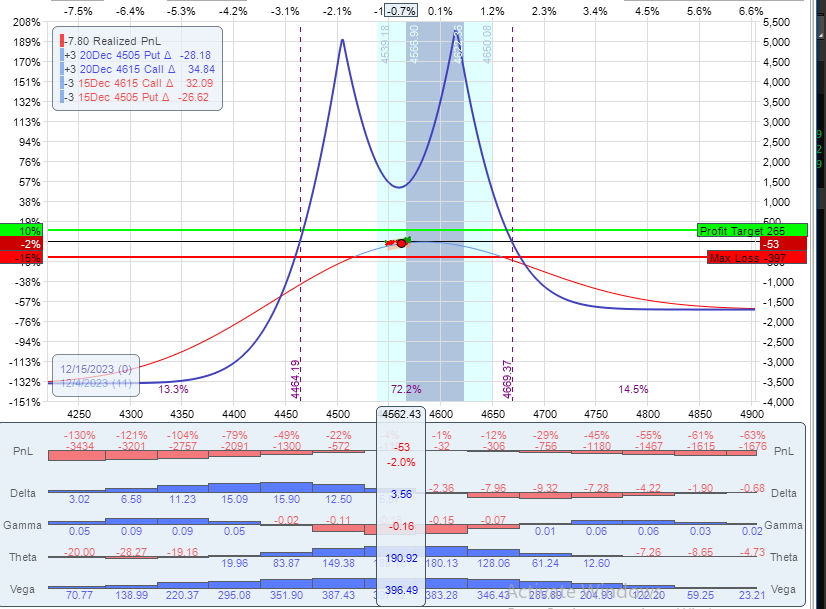

On Monday December 4th, I put on a small double calendar with the shorts 11 days out and the longs 5 days after the shorts. Obviously all of these contracts expire after the events of the following week. Here is how the trade looked when I entered it:

SPX 11-day Double Calendar: Delta: 3.56 Gamma: –.16 Theta: 190.92 Vega: 396.49

What's important here is the extrinsic greeks of these options, especially theta. This trade is only 11 days to expiration and as a 3-lot has $190.92 worth of daily theta. So, theoretically, I should make $190.92 per day on time decay. As long as we don't move a ton, this should be an relatively easy trade. And in this week, SPX doesn't move very much. But here is the same trade at market open on Friday, December 8 (4 days later):

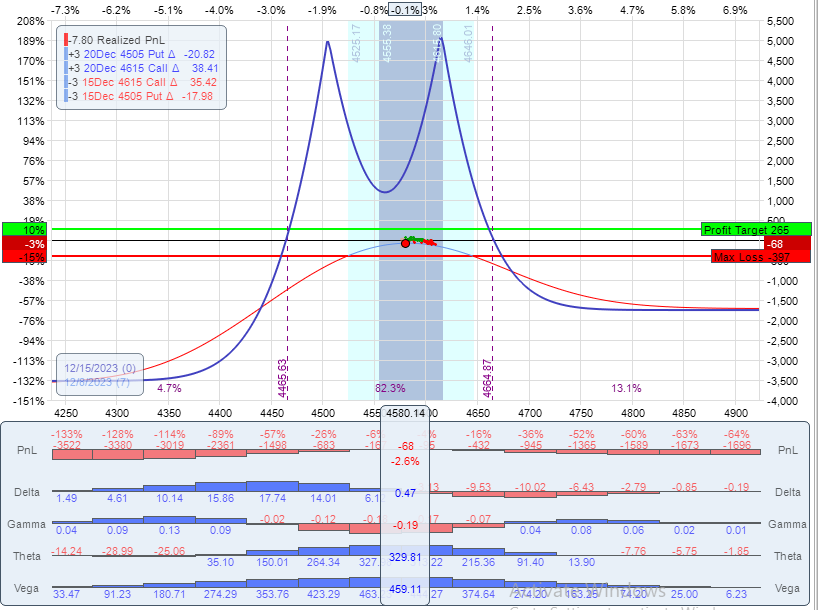

SPX moves 17 points in 4 days

When I put this trade on Monday, SPX was trading at 4562.43. At market open on Friday, SPX was trading at 4580.14. That's a little over 17 points up in a week which is a very calm week for SPX. In theory I should be up at least a couple hundred dollars, right? Nope. The trade is down about $68. Well, that doesn't seem right! Theta at this point is 329. Surely I should get at least some of that over 4 days. Why am I down? The answer is the big events the following week have been priced into the options contract and the market makers aren't going to let me out of the trade that easily because my shorts expire 2 days after the big FOMC announcement. If I want to get paid on these contracts, I'm going to have to wait until the news is out and take the risk. I took the trade off that day for about a $90 loss. The experiment failed.

Strategies Around Events

So how do we, as traders, work around this problem? There are several strategies each with trade offs.

- Avoid trading during these times.

Sitting in cash through big events is one way to avoid the mess. Just don't risk anything. The downside of this is, of course, that you aren't making money either. But it's valid. - Only trade options that expire before the event. Contracts that expire before the event are, logically, not affected by the event since they will not exist when the event occurs. The risk here is that as the event gets close trading very short term has other risks, namely price movement risk which increases as the contracts get close to expiration. So while you are avoiding the risk of the event, you are taking on more delta and gamma risk.

- Ride through the event. You do have the option of taking your trade through the event. After all, that extrinsic value has to come out eventually, right? Yes, but the reason this event is affecting the theta in the first place is it's an unknown risk. There are times when it's less risky than others to do this. It really depends on the trade and how much price movement room you have and, especially, how much money is at risk on the trade. Size is the first and most important part of risk management.

- Trade contracts further away from the event.

Contracts that expire after the event will still be affected by the event, but the further away they expire from the event, the less they will be affected and the more time you may have to adjust it if needed. I will show an example of that below. The risk here is the risk of more time. Longer term trades usually take longer to work which means there's more time for something to go wrong.

None of these are right or wrong. I've done all of them at one time or another. The idea here is to show that everything you do has a trade off. There is no one correct answer. The goal here is to understand the risks that are inherent in any strategy.

An SPX 16-day Calendar

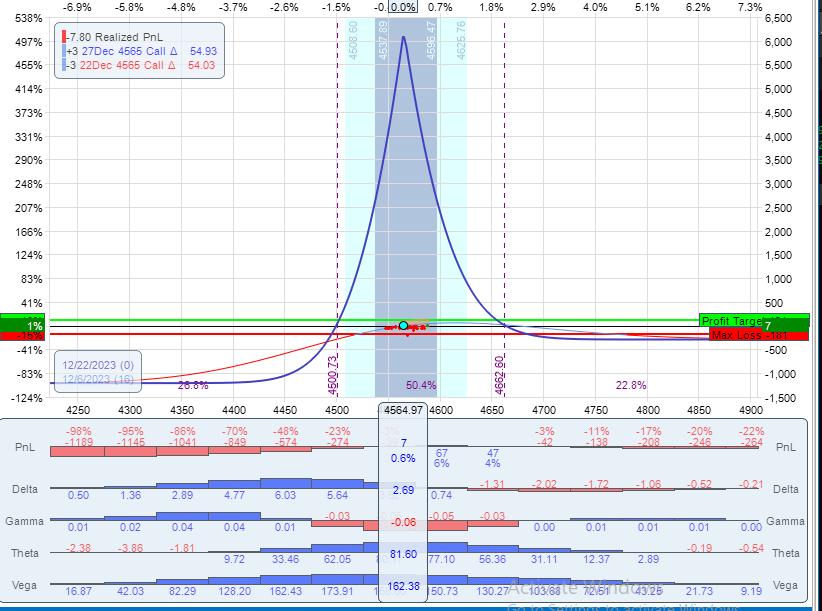

So here's another trade I put on that same week. I put on a 3-lot Calendar on Weds December 6. but the shorts expired 16 days later (or 1 week later than the first example). The trade was definitely affected by the CPI/FOMC events, but not quite as much as we will see. This is trade as I put it on:

Delta: 2.69 Gamma: –.06 Theta: 81.60 Vega: 162.38

This trade has a week longer than the first one and so the Theta is definitely less than the double calendar, but it's still pretty healthy. Now let's look at it on the open on Friday:

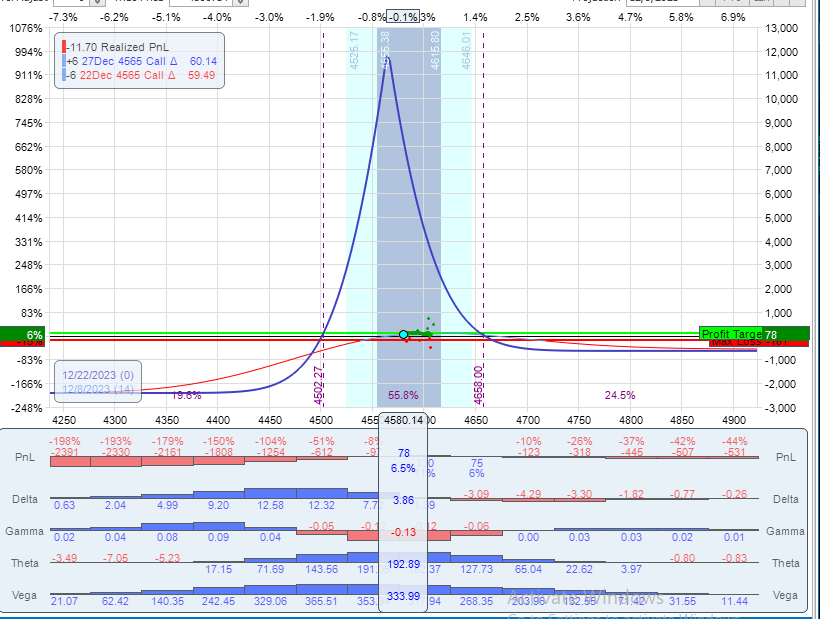

2 days later

This is very interesting. This trade is barely 2 days old and look at the difference. The market hasn't really moved, but the trade is up about 6%. That is likely not as much as it would be in a similar market without the events, but it's something. Even one week later can lower the effects of the event a bit. For those who trade even further out, the effect will be even less. But, as I stated before, you are trading one set of risks for another.

The goal of this post isn't to give one answer. Rather it is to understand the risks of big events and how they can affect trades and getting you to first, be aware of big events because they matter and second, understand what you can do about them. No one will handle this perfectly, that's not how trading works. But if the goal is to manage risk, it's important to understand what risks you are actually taking. The greeks can help you quantify them, but they can't always tell you the whole story. Situational awareness matters. A mathematical pricing model can't know about an event. But you can and you can plan accordingly.

Good trading.

This content is free to use and copy with attribution under a creative commons license.