Pro Tip: Price Fishing

Originally posted on September 5, 2022

This may be a topic more suited for newer traders but it is something I’ve seen come up from time to time so I think it’s worth writing about here. When putting in orders, especially on multi-legged spreads, how should traders enter orders to get a fair price?

The Market is an Auction

The first thing to remember when thinking about prices is that the options market is not like a store where you look at a price and decide if you want to buy or sell a contract. It’s an auction where prices can literally change by the second. As a market participant you will get to see what buyers want (the “bid”) and what sellers want (the “ask”). The theory is that buyers and selles will meet somewhere near the middle (the “mid”). For a single option leg (where you buy or sell some amount of exactly one contract), the distance between the bid and ask (the “spread”) gives some indication on how much liquidity exists in that particular contract. The less the difference, the more interest there is in that contract, and the easier it is to get a fill. For very liquid contracts, it’s common for the spread to be a penny or two.

But multi-legged spreads make this a bit more complicated. Even if all of the contracts have small spreads, when we combine the spreads of 2, 3, or even 4 legs, the spread of the entire trade gets larger even if the spread of each contract isn’t very wide. So the question becomes how do we, as traders, find the right or fair price?

Limit Orders

A quick side topic that I think is really important on the topic of orders: Always use limit orders. A limit order gives the most you will pay or the least you will accept for the order to be filled. This is critical to getting a decent price. The alternative is a market order which tells the broker to fill the order at literally any price. While it’s possible to get a good price with a market order, you are taking a big chance of getting a bad price, maybe a very bad price. Limit orders give you, the trader, a measure of control in whether a order is filled or not. This is especially true for opening orders, but it’s just as true for closing orders or adjustments. It’s ok to not get filled if the price is bad. And while it’s easy to get frustrated at an order not getting filled, do not get impatient and resort to a market order just to get it done. Just like in real life, you need to be able to walk away if the price is not right. This can be frustrating when trying to exit a trade when the market is moving against your position, but I still hold that limit orders are the right way to handle this.

Understanding What is the “Mid” Really?

So what is a “fair price”? Well, the simplest answer would be the mid (the midpoint between the bid and ask). But here’s the problem: offers from buyers and sellers are coming in all the time. This moves the bid and ask around which, in turn, moves the mid. So, in theory, there is a mid price but, in reality, there is really a mid range. You will see the mid range by watching the mid price change. In most market conditions it will bounce around. How much depends on the liquidity and volatility of the contracts but the vast majority of the time you will be able to see the range just by watching it move. This range becomes the basis of what I call “price fishing”.

Closing for a Profit

The simplest case is when I am trying to close a trade for my target profit. I simply have a GTC (Good ‘Til Cancelled) limit order at the price I want. By doing this if my exit price can be filled, it will whether I’m at my station or not. I don’t sit in front of my station all day. I have a life outside of trading that included a day job. So I always have a limit order in at the exit price I want to meet my profit target. The only exception to this is if the trade has more than 4 legs. Then I have to manually enter 2 separate trades to exit. In my trading, this only happens if I have a double butterfly (which has 6 legs). All of my other possible trade structures have 4 legs or less which allows me to always have a closing order at the broker. The market can

Opening, Adjusting, and Closing for a Loss

Closing at my profit target is the easiest case. For the rest, I am putting in orders myself and in these cases I deploy price fishing. The idea is that I don’t know the right price, but I can see a range of reasonable prices. So I start by placing a limit order a bit above the top or below the bottom of the mid range (depending on whether I am selling or buying). Then I move up or down until I either get filled or I walk away from the trade. Initially, I may put in new orders quickly, but as I get closer to the center of range, I tend to slow down and give it time to fill. I rarely get filled on my first order. In fact, if I do it’s a bit disappointing because that means I may have been able to do better with a bit more time. Or maybe I just got lucky with a really good price. But the key is to put out offers and see where the fish are biting.

A Real World Example

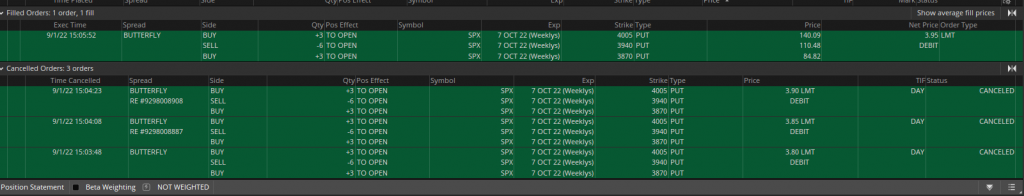

This wouldn’t be a MidwayTrades blog without at least one real world example. So on a recent trade I was opening, I captured the orders I put in to show how I fish for prices. Below is the order log of a trade I opened recently:

Price Fishing a Butterfly

This trade opens a 3-lot unbalanced (65 up / 70 down) butterfly in SPX. I started at the bottom by putting in an order for a $3.80 debit. This was likely $.10 under the range I was observing at the time. Then 20 seconds later, I upped my order to $3.85 ($.05 is the smallest I can do spreads in SPX). About 15 seconds later I put in a new order for $3.90. Those were pretty fast, but this is normal as I started about $.10 under the range I was observing. The goal here is just to see if I can get a deal. If not, I move forward. Now I waited a bit at $3.90, eventually putting in a new order at $3.95 which filled nearly a minute and half later which means I sat at $3.90 for a minute or so, waited some more and then got filled about 30 seconds later.

The point of doing this is that I can’t know what the “right” price is…and even if I did that price could change by the time I put in my order. So like a fisherman, I cast out a few times at different places, depths, etc. to see where the fish are biting.

So that’s what I do. What do you think? How do you find a good price? As always, I love to hear from folks out there. Feel free to comment here or send me an email at midway@midwaytrades.com.

This content is free to use and copy with attribution under a creative commons license.