Pro Tip: Always Have a Closing Order

Originally posted September 16, 2019

This is a quick post that demonstrates something I’ve been taught from early on in my options trading and I think this example makes it very real. When you open an options position, always have a closing order in your trading platform, even if it seems implausible. Most of the time, nothing special happens and things close around the time you think they will. But ever once in a while, you catch a break and get something unexpected.

This is a quick post that demonstrates something I’ve been taught from early on in my options trading and I think this example makes it very real. When you open an options position, always have a closing order in your trading platform, even if it seems implausible. Most of the time, nothing special happens and things close around the time you think they will. But ever once in a while, you catch a break and get something unexpected.

As I talk about closing orders, I think it’s also important to stress that importance of the type of order. I only enter limit orders not only for closing a position, but also opening and even adjusting a position. I never enter a market order. In my view, market orders are for suckers. You are relinquishing all control to the broker who has no incentive to get you a reasonable deal. It’s easy to think that you’ll just get the bid or ask price but that isn’t necessarily the case. With a market order, all the broker has to do is fill your order at any price. In some cases, your broker may also be a market maker and so you are literally letting them set the price for themselves. But even in the case where they are not market makers, they will still get their commission for doing no work on your behalf. A limit order puts you in control (as much as you can be in the market). In order for the broker to make the commission, he (or most likely their computers) will have to fill it at a minimum or maximum price set by you. This means you may have to work the order a bit to get a fair price. But at least you have some control over the price you are going to pay with your money. In a perfect world, you’d get filled at the mid every time but, in some cases, it’s reasonable to cave in a bit to get filled. If the market is moving too fast to get a reasonable price (usually on the downside) and you can’t close a losing position then, in my opinion, you grab a long put with enough deltas to flatten out your position and wait for things to calm down. That is far better than doing a market order of any kind.

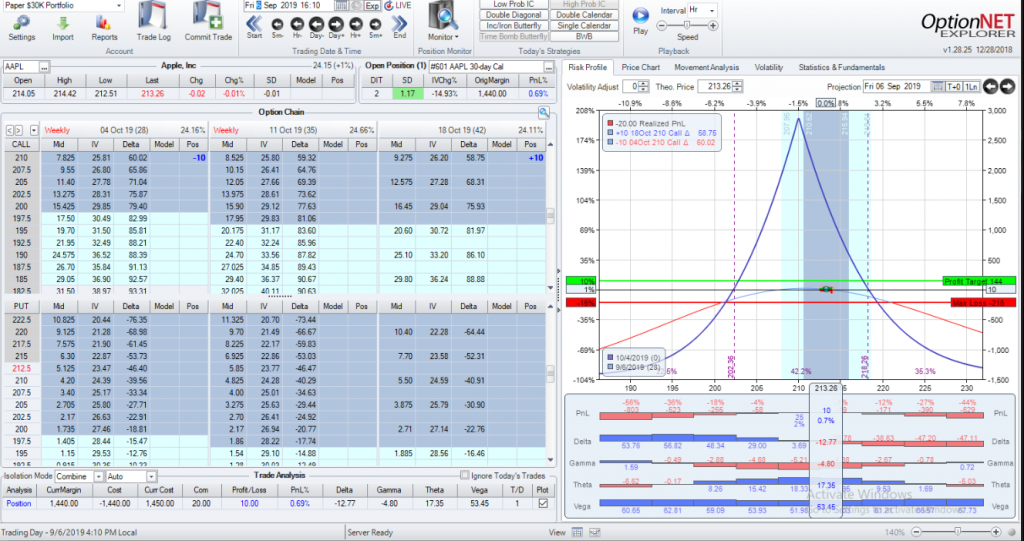

Now, back to the real topic at hand. I recently put on a calendar trade in Apple (AAPL). It was doing fine and I let it run over the weekend. This is how the trade looked at the close of the market on Friday:

My Calendar in AAPL going into the weekend

As you can see, I’m up a bit with a reasonable delta for a 10-lot (1.2 per calendar), decent theta with good room on each side. I’m perfectly happy going into a weekend with this trade. My goal is to make 10% on the trade but in the first week of a 30-day trade, I’ll gladly take 7-8% and call it a day. You’ll never go broke taking a profit. So Monday rolls around and at the open, my graph looks like this:

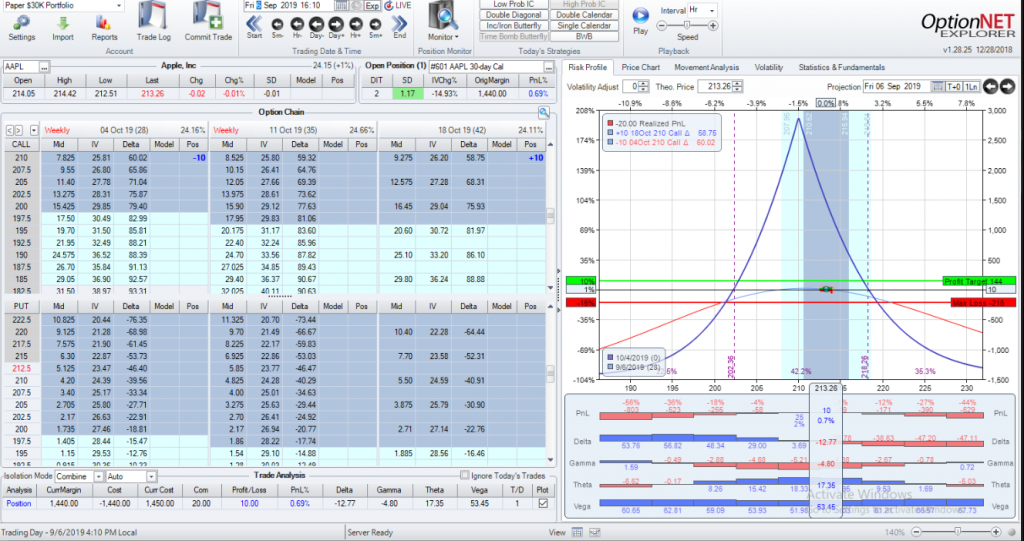

My Calendar in AAPL first thing Monday morning

Gee, that doesn’t look very nice. But we did open up a bit and this is just a snapshot of the mid price at that moment. In reality, it bounced around a bit and near break-even or even down $15 or so was pretty reasonable given I was short about 12 deltas on the position. Sometimes the first prices of the day are a little wild and so the mid price can jump a bit. This is normal market stuff and as a trader, you have to be used to it. But what actually happened?

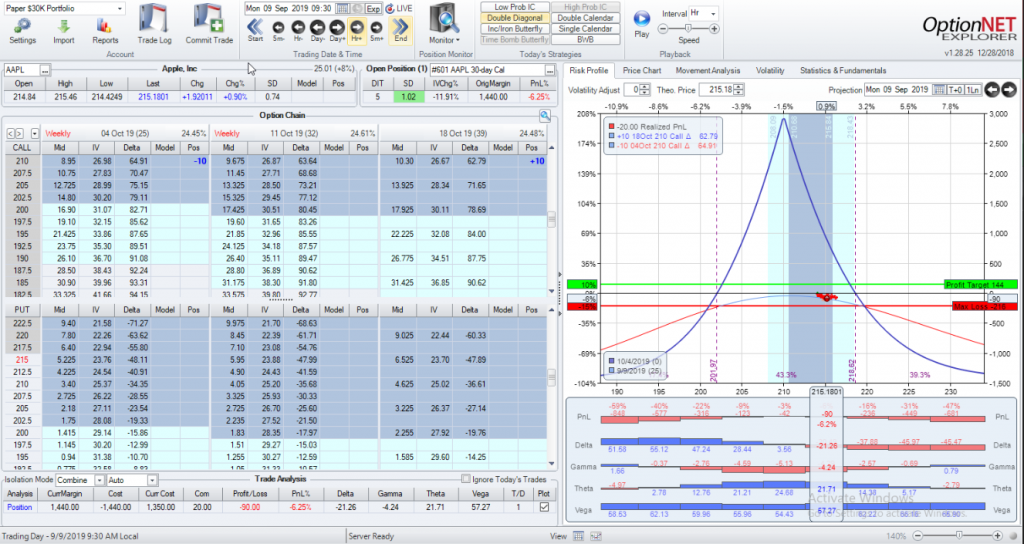

My trade closed for $140 gross profit ($100 net) right at the opening!

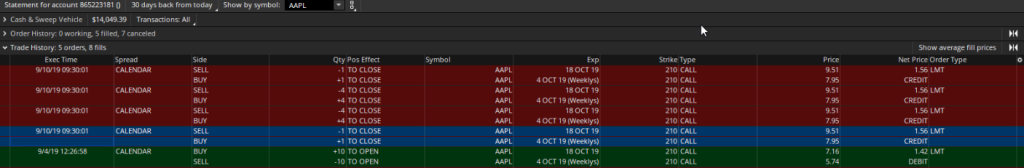

My trade closed for $1.56 literally 1 second into the trading day on Monday! Note I paid $1.42 for it the previous week. That’s a gross profit of $140, or $100 after expenses (it’s 20 contracts in and 20 contracts to get out and I pay $1/contract commission) for a 7% profit. WTF?!

This is the magic of having a closing order in the system at all times. Apparently AAPL was trading all over the place at the market open and my broker was able to fill my order for my target price. I have no idea how long this price was available, it could have been literal seconds, but I was filled and my position closed for a good profit for 6 days. It would have been tempting see that it should take several days to get close to my profit target and not have a closing order in the system. What’s the point, right? This is the point. Sometimes you get filled even when you don’t think you should. But you can only get filled if you have an order in. And because it’s a limit order, you are assured at a minimum price to get out.

The one thing of which you need to be mindful when having a closing order in the system is when you want to adjust. If the adjustment you want to do involved any of the contracts in the closing order (e.g. rolling an option), then the closing order will need to be cancelled before the adjustment can be made. If not, the platform may think the adjustment is a new position and it could mess up your position with potentially naked shorts, etc. This is why it’s important to have a clear head even when things are flying around. Take your time and get the orders right. The few seconds you are trying to save by rushing can actually cost you more by putting in something wrong.

So, I hope you can see from this example why having a closing order in at all times is a good thing and really can’t hurt. Also, limit orders are your friend.

This content is free to use and copy with attribution under a creative commons license.