Managing By The Greeks

This year has been challenging for trading, specifically for range bound traders like myself. The market has been moving a lot on news from the US administration on things like tariffs. Some of these moves have been very large and very quick in either direction. How can a trader respond to these types of unexpected moves? One solution is to sit things out until things calm down. But there should be a way to try and make some money in this type of market without resorting to guessing direction. I've been thinking about this a lot lately and want to share my approach to risk management in a highly volatile market.

First and foremost, I use the first and most important risk management tool: size. This is something everyone can use, regardless of skill level. When markets are volatile, reduce the size of the trades and, thus, the amount of risk on the table. It's a very simple idea, but one that is very easy to forget.

Now to the main part of this post. How do I tweak my risk management to minimize the damage of big market swings? To do this, I rely heavily on the Greeks, most importantly the price risk Greeks, delta and gamma. Gamma is the easier one as it doesn't come into play until around expiration week so if you can go out in time, you can minimize gamma. Delta requires more work. I have made some tweaks to my risk management plan that tries to minimize my position deltas and, therefore, my price risk. Is it perfect? No. There will always be some kind of move that can mess up your trade but the goal, in that case, is to minimize the damage to the trade and, ultimately, to the account. I watch my position deltas very closely and make smaller adjustments to keep them in line as much as possible. It doesn't always turn a loser into a winner (although sometimes it does), but it can turn a very bad loser into an acceptable loser which, to me, is just as important.

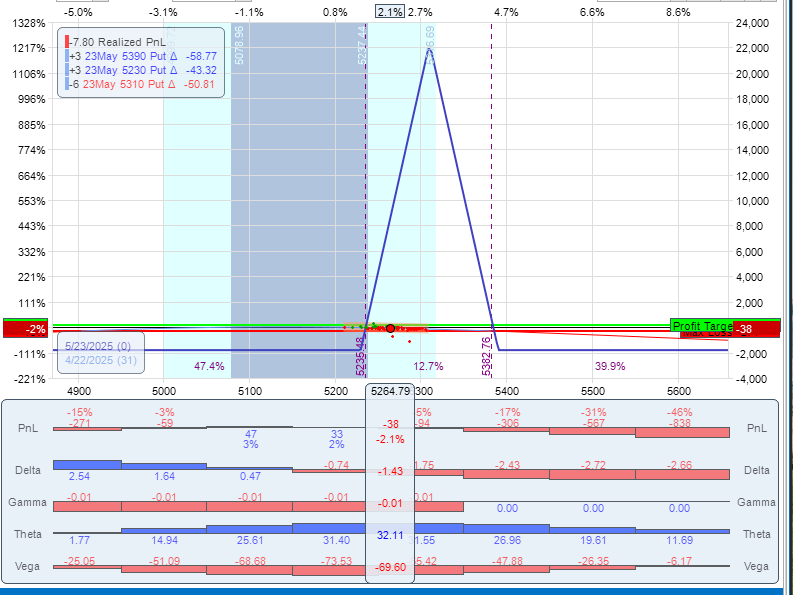

As usual, I will provide a real world example in SPX. The idea here is to learn. This trade was not profitable but I want to show how it's possible to rescue a trade that gets caught in a fast moving market. This is very recent trade that started on April 22, 2025 and ran for almost 30 days which is as very long time for my trades. But I went out that far to lower my price risk. When I put on this trade, the VIX was 30.96, which is definitely on the high end of the normal range. So I decided to put on a balanced butterfly. Why? I wanted to be short Vega since IV was high and when IV is high and butterflies are short Vega. I chose a balanced butterfly because when IV is high, they tend to have very low initial position deltas then when IV is lower. This meets my risk requirements of being an IV contrarian as well as keeping my deltas as flat as practical.

I centered this trade about 35 point above the money. Why? The greeks. This trade has -1.43 deltas on a 3-lot which is quite flat. The short deltas will benefit this trade on the downside, and the 35 point cushion away from the money gives it room to run on the upside so that I should have time to react if we go up quickly (SPX was up 106 points on this day). The only bad thing for this trade would be a large move up....and that's exactly what happened.

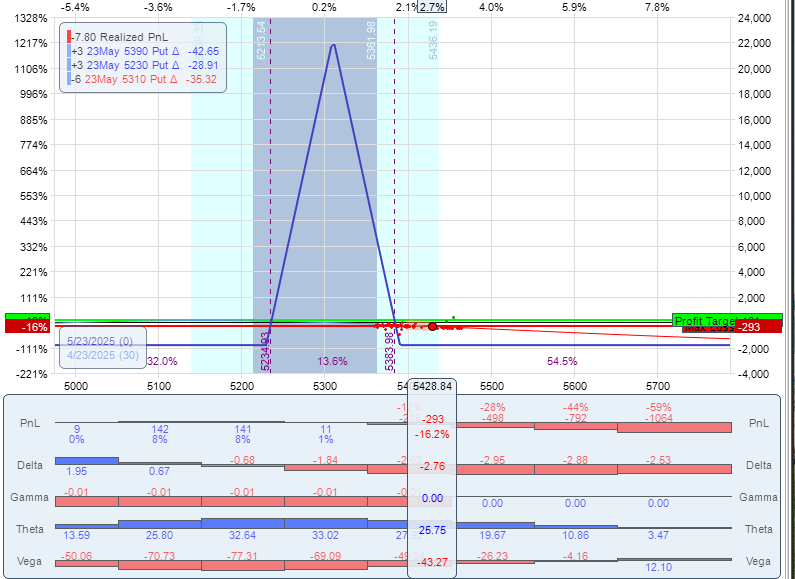

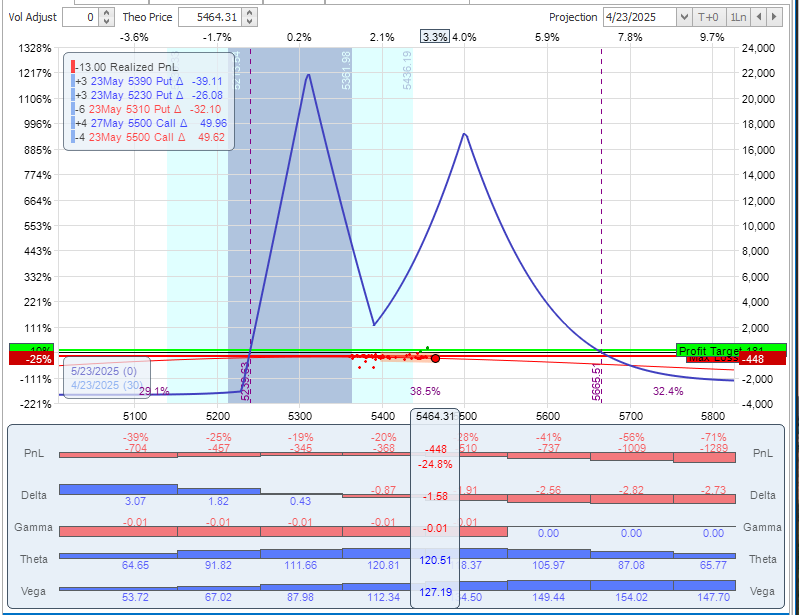

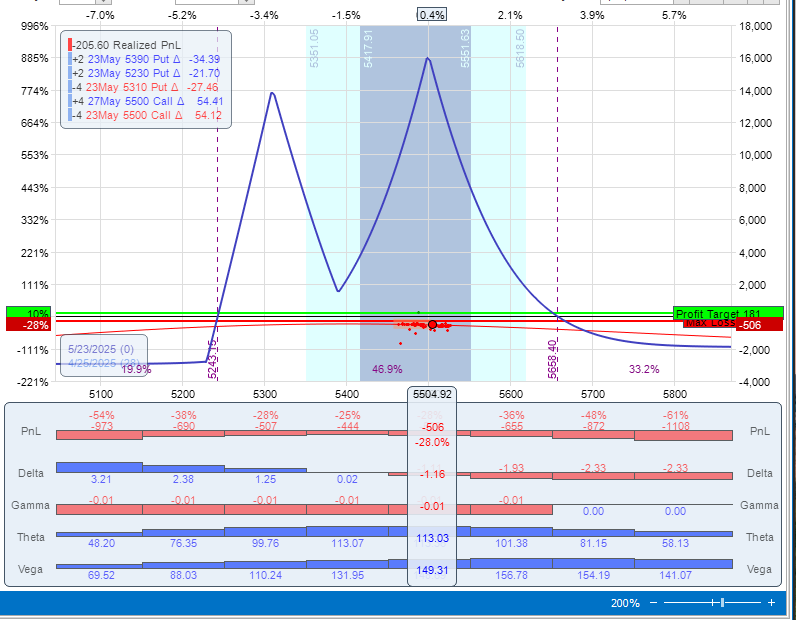

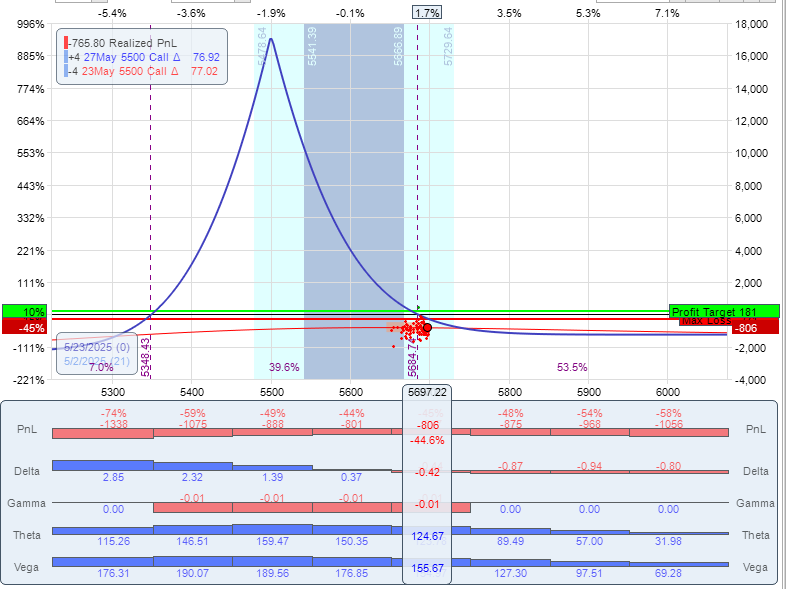

SPX opened up another 141 points. This trade now looks blown out. One response could be to just close it for, probably around a 20% loss. But I chose to try and manage it. The one thing this trade has going for it is time..this is literally the first full day in the trade. So I look at my trade and my goal is to do 2 things: widen my profitable tent and lower my position deltas. By the time I was ready to adjust (I waited almost an hour to see if there would be a pull back) my position deltas were about -2.96 which isn't bad, but any adjustment I do will not want to increase the deltas (in absolute terms) but I'd also not like to flip to positive deltas either in case we do pull back. So I add 4 calendars about 35 points above the money at 5500.

This expands the tent quite bit, and cuts my position deltas to -1.58, basically in half. My next time to consider an adjustment on the upside would be around 5500 (the center of the calendars). SPX gets there about 2 days later.

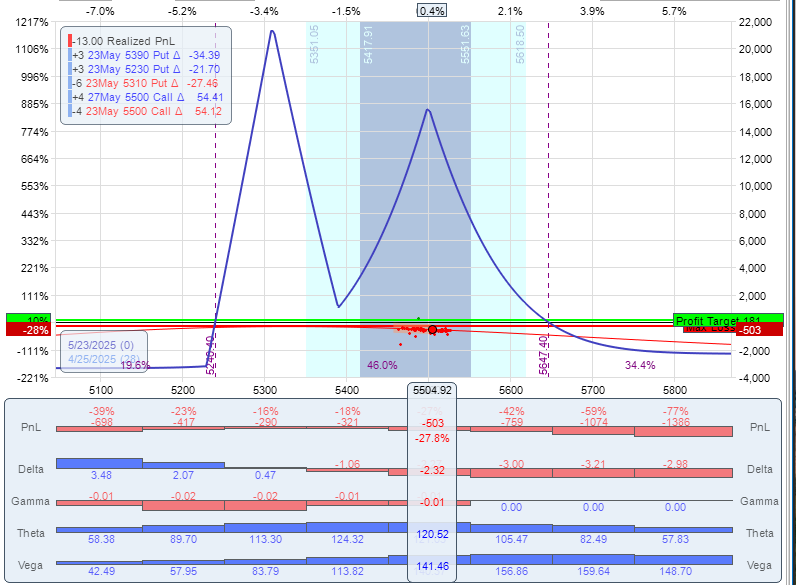

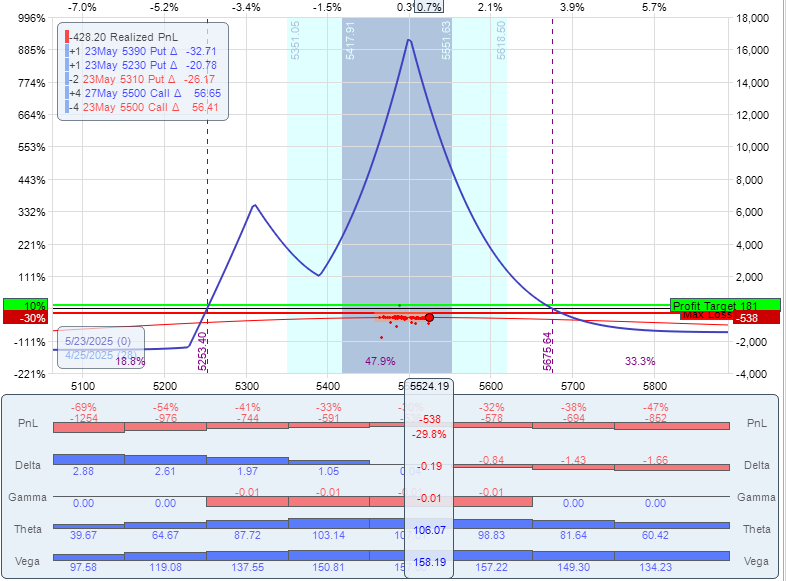

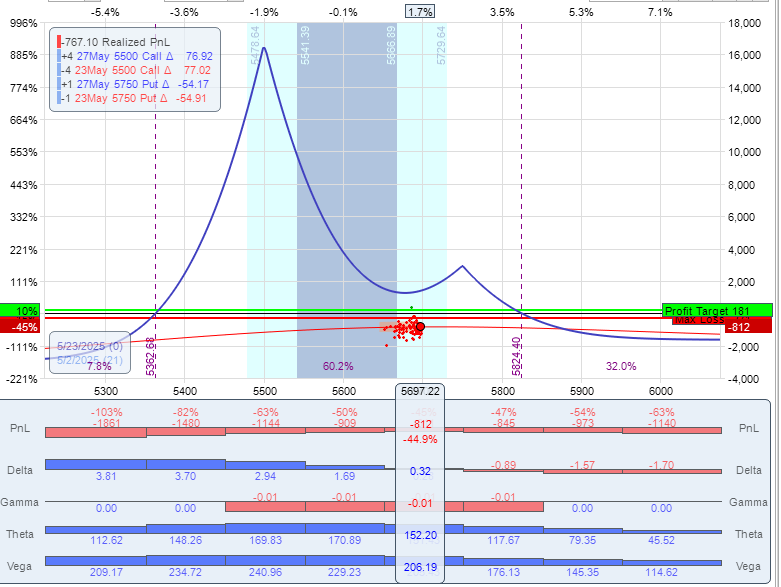

So now SPX is at the center of the calendars, and delta has gone up to -2.32. This trade isn't in terrible trouble yet, but I'd still like to keep my position deltas low. So I decide to take off one of the original butterflies (there were 3 to start).

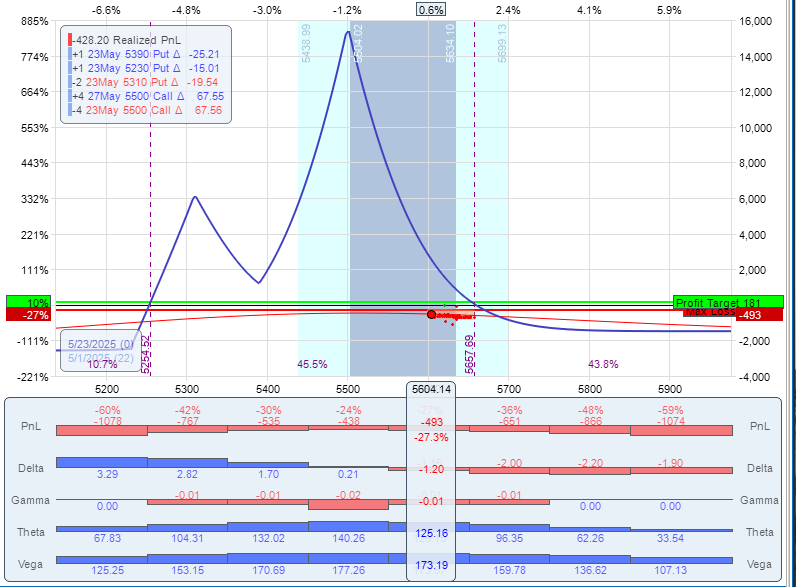

This keeps my tent wide, lowers my position deltas to -1.16 and takes some risk off the table since I sold off one of the original flies. While the day wasn't a wild one, SPX kept going up so before going into a weekend, I took of another of the original flies.

This cuts my position deltas to almost 0 going into the weekend. And then something nice actually happend. The market didn't move like crazy for nearly a week so I didn't have to do anything for most of the next week. The only issue was the P/L which was still down quite a bit, 25-30%. My goal is to wait as long as possible for time and, possibly, IV to help me. IV dropping was hurting this trade as the calendars made it long Vega so I'm just waiting it out and watching my price risk. I do nothing with this trade until Thursday of the next week (May 1, 2025) when the trade looks like this:

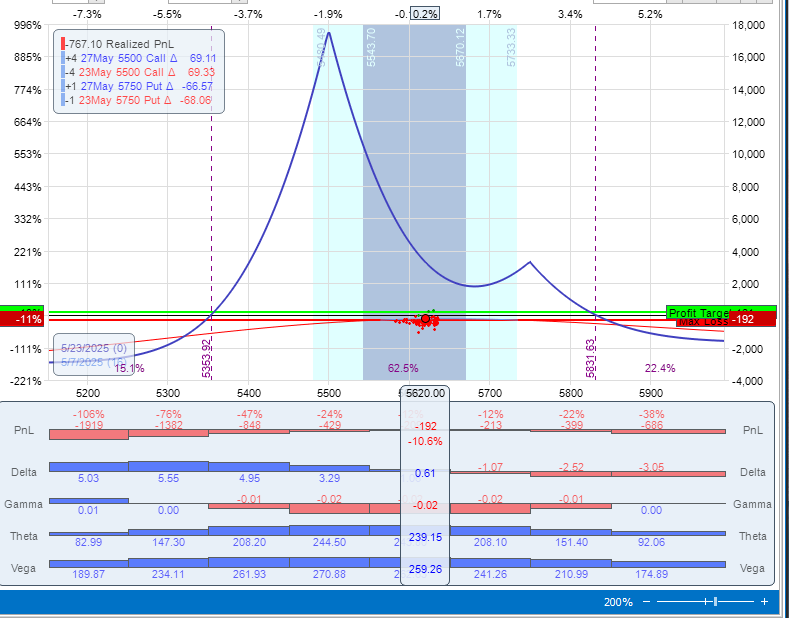

My concern here is if SPX keeps running up as it's been on a slow grind up over the past week. I don't need to do anything too drastic, but I do decide to finally give up on the last original butterfly as SPX has gone up way beyond it being useful at this point.

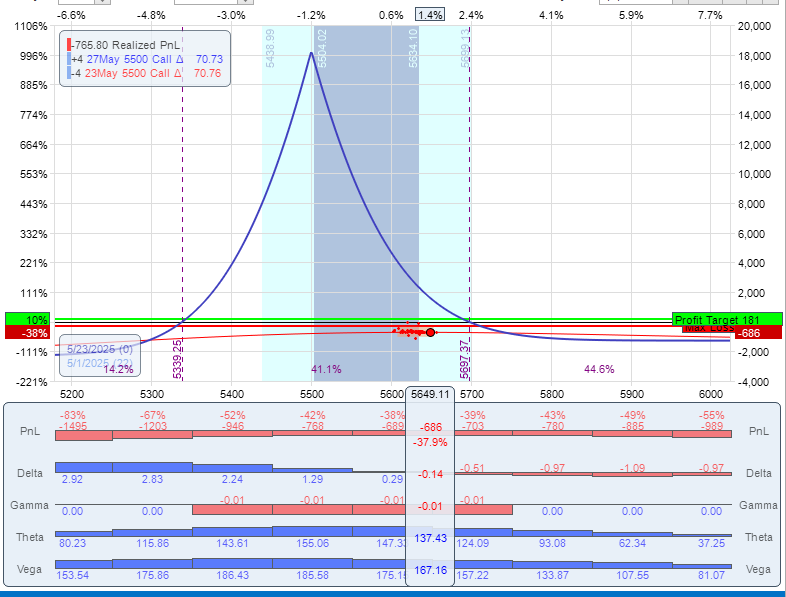

By the next day, SPX moves up another 90 points by mid-day. So I'm glad I cut the deltas. My issue now is I'm running out of room on the calendar tent.

In this case, delta isn't really a problem, but the calendar tent is so I add 1 calendar to the upside. This technically flips the sign on my delta which I prefer to avoid, but the absolute value in so low, it's a trade off I'm willing to make.

Now, there comes a point when every trader has to decide what to do with a trade. This trade has been through a lot. What happened after this last adjustment was about a week of calmness. Around mid-week, the trade looked like this:

At this point, the trade is about 8% down. Recall when it first got into trouble it was about 20% down. For me, this is a good time to just take it down. This trade was likely never going to be a winner, but sometimes the best you can do is minimize the loss and have it do less damage to the account. Would taking it off at 20% been wrong? No. As you say, it got much worse before it got better. But this was an experiment I ran to show that managing a trade by the Greeks can help navigate a crazy market.

I hope you found this post useful and can incorporate some of my ideas into your trading. As always, reach out with questions or comments.

This content is free to use and copy with attribution under a creative commons license.