Comparing Directional Plays

Originally posted August 14, 2019

A lot of folks like to use options because of the leverage and lower costs vs buying and selling shares of stock, especially on high-priced stocks and indices. While I usually use options to trade non-directional strategies that rely on time decay rather than price movement, there are times when it’s fun to get a little directional. Sometimes (like right now), it’s tough to be non-directional because the market is moving all over the place and price movement makes it tough and not worth the risk. So, I thought I’d compare a few strategies for directional trading. The first few you’ve probably seen before, and one that you may not have seen but I think is really interesting.

For the purposes of this post, I’m going to be bearish on Tesla. No particular reason, this is just an example, not trading advise. I actually have no real opinion on Tesla, but it’s a high-priced stock (around $235/share) so it makes for a good example. Of course shorting the stock is very risky and expensive because while a stock can only got $0, there’s no theoretical limit to how high it goes so shorting is a dangerous and expensive game, IMHO. However, I fully believe that retail traders can use long PUTs to go short on a stock without the undefined risk. Since you are in a long or covered position, your risk is defined and so you know how much you can lose and your broker won’t ask for you first born in margin. It’s one of the cool things about options.

Strategy 1: But Long Puts

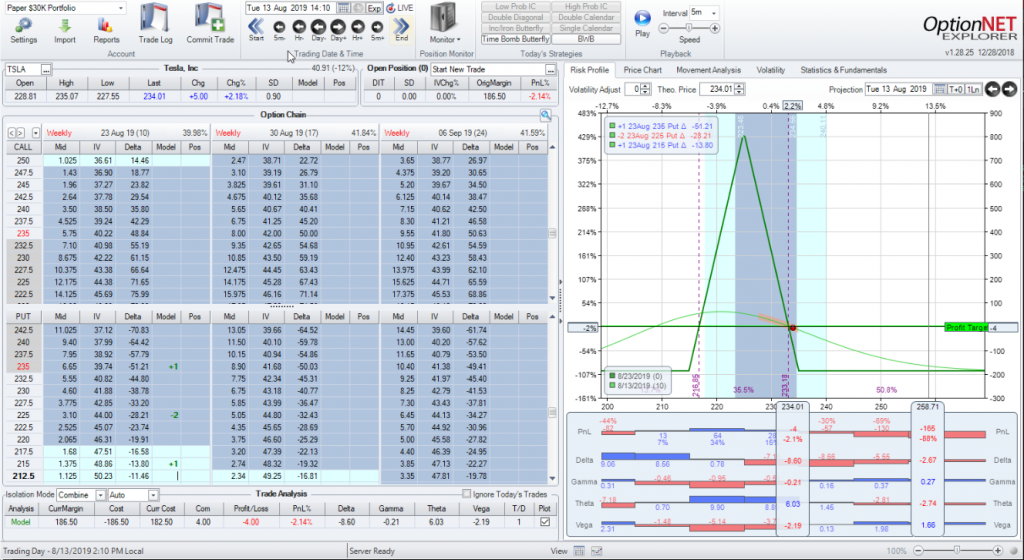

This is the simplest strategy and probably one that most folks who know anything about options would understand. So if I’m bearish on TSLA, I could buy a put at-the-money (10 days out) for about $665 (plus commissions, of course). Not bad for a $235 stock. And way less than what your broker would want you to put up to short 100 shares of TSLA. Your total risk is what you paid for the put (so $665/contract) and you can scale your up to whatever level at which your are comfortable. The trade looks like this:

Buying a single $235 put 10 days out

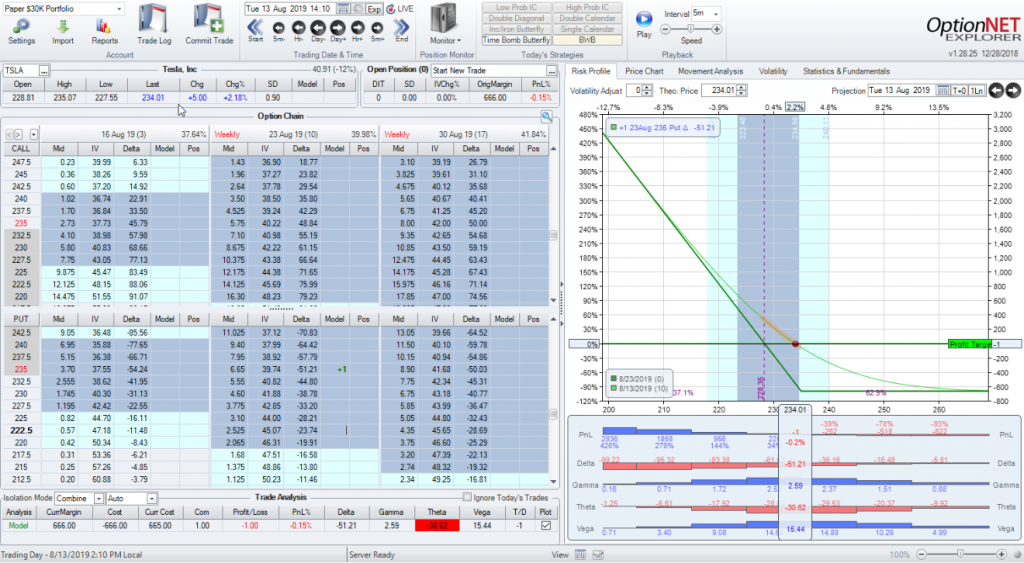

In this trade, my break even is if TSLA hits $223.35 since I need to cover the cost of the put. And because we are only 10 days from expiration, I’ll need it to move soon as I’m losing about $30/day in time decay and this will increase a bit each day. I could always go out further in time to allow it more time to work, but I’ll pay more. For example, at 31 days to expiration that same put would cost $1208 which means TSLA needs to get below $222.83 (similar) but I’m only losing $18/day to start to time decay since I have more time.

Buying a single $235 put 31 days out

You could go further up or down in price and time and the number would change, but you get the idea. This is a very simple strategy that is bearish on TSLA but gives you limited risk. Nothing wrong with it, but what if we could do it cheaper?

Strategy 2: Put Vertical Spread

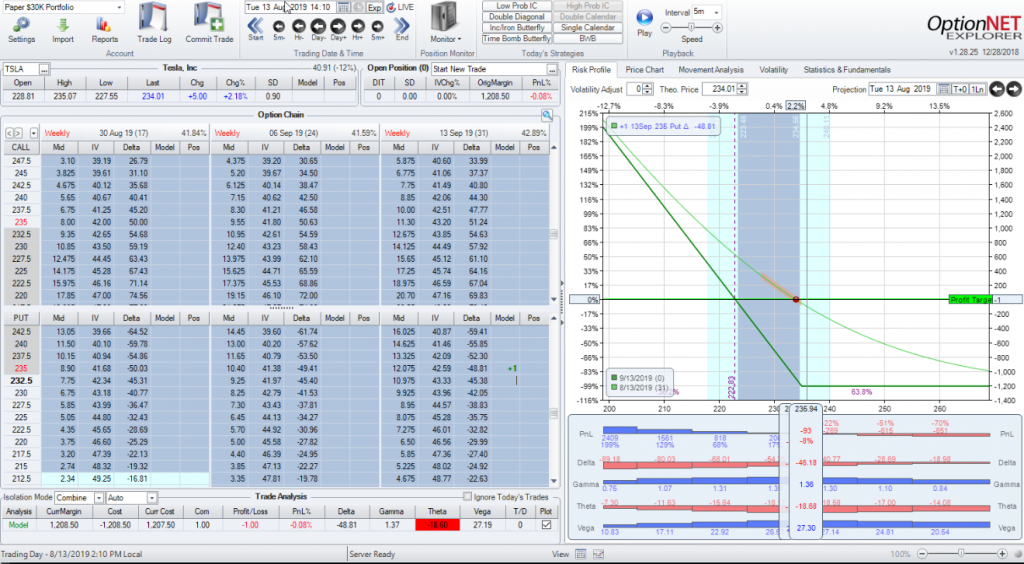

So one way to reduce our risk and still be bearish on TSLA is instead of just buying a put, also sell a lower cost put against it. This does a couple of things for us. It reduces the risk since we are getting a credit for selling something, and it reduces our time decay (and can even get time to work for us). So to keep it consistent to start, let’s do a 5-point vertical spread buying the same $235 put 10 days out, but also selling a $230 put against it.

Buying a 10-day put vertical ($235/$230)

Look at what happened. First, we have reduced our total risk to $205 plus commissions per spread. That’s a 70% discount to just buying the put. And on top of that at the start of the trade, time is working for us instead of against us as we’ll make $.40/day to start and if TSLA goes down that will increase significantly.

Now, there’s no free lunch so what have we given up by doing this? The big thing we give up is because we sold a put along, we cap our maximum upside to $293. That’s about 140% of the risk where if you look at the long put, it can make a lot more if TSLA goes down hard. With the vertical, even if TSLA went to $0, the most we’ll make is $293. That’t still a really good gain and I’d probably get out before it ever got there, but it is a limit so if you’re shooting for the moon, you may not like this strategy. However, I like the idea of the reduced risk if we’re wrong and the initial positive theta which means we aren’t losing money to time decay (unless TSLA goes up). And, of course, our commissions will be a higher since we are trading more options so keep that in mind.

But what if we could make this even cheaper?

Strategy 3: Directional Butterflies

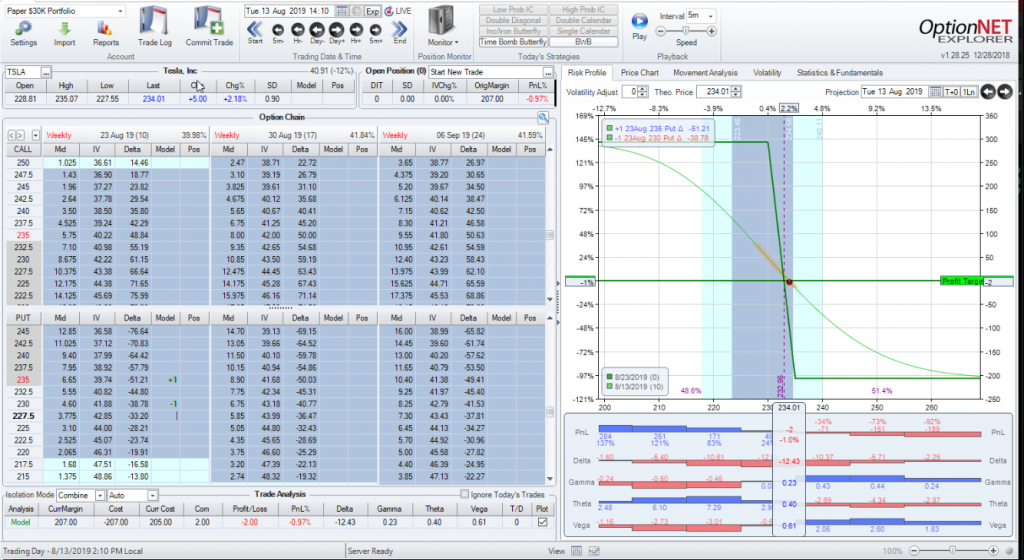

Here’s a strategy you may not have seen before, and it may not be to your liking, but I really like it for certain situations. It’s a bit more complex but it’s REALLY cheap. It’s called a directional butterfly. What’s a butterfly? Well, if you’ve never seen a butterfly before, check out my Options Fundamental Series, particularly my episode on Butterflies. But, in short, a butterfly is 2 vertical spreads with the same short strike. So a single butterfly will typically follow a 1-2-1 pattern which you’ll see below. In this example, I’m going to keep the same vertical spread I did above, but add a second vertical even lower to reduce the cost even more.

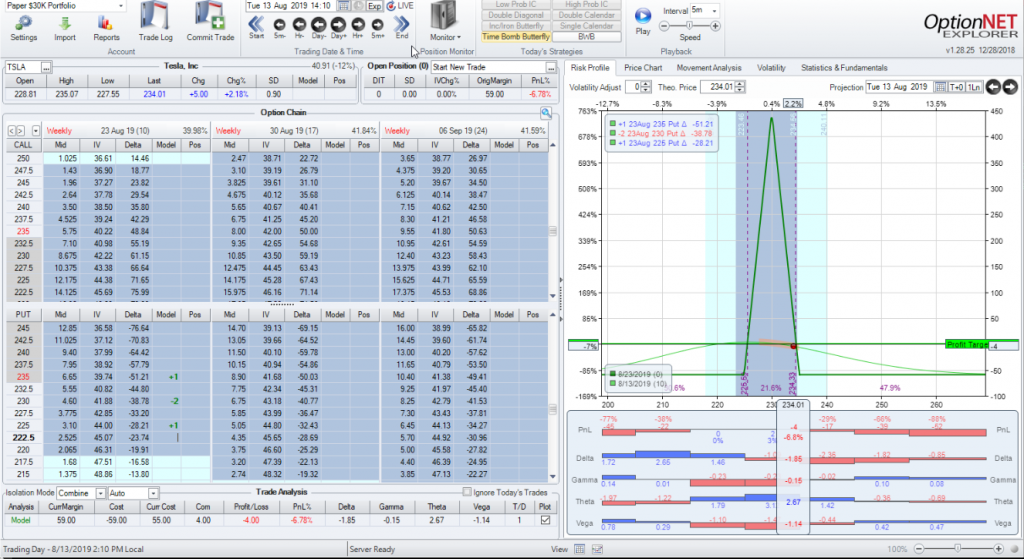

Buying a TSLA directional butterfly. Buying 1 put at $235, selling 2 puts at $230, and buying 1 put at $225

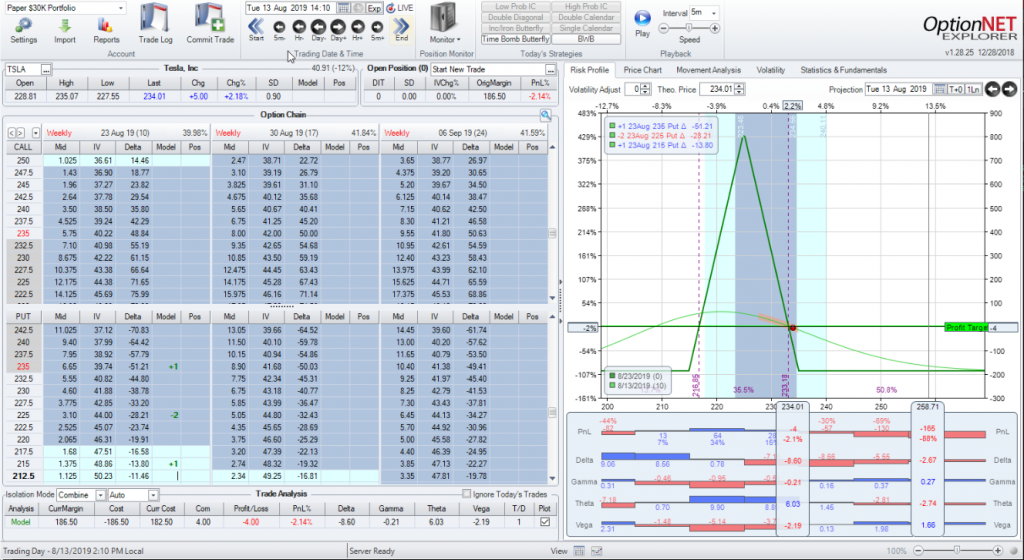

Wow! I put on this trade for $55 plus commissions! That is the most I can lose. And I have even more positive theta so at the start of the trade I’m making $2.67/day. Too good to be true? Again, what am I giving up? In this case, if TSLA goes way down, I can lose money again. I have some risk on the downside as well as the upside. So TSLA has to go down, but not down too far too quickly. And because this trade has 4 contracts, my commissions will be even higher than the vertical. I can scale this up by adding more butterflies, but watch the commissions as it’s 4 contracts per fly. On the plus side if TSLA only moves to around my short strikes ($230), I can make quite a bit more than the vertical. I get that in exchange for having risk on the downside as well. I can tweak this around by moving the fly up or down for more or less money as well as adjusting the width of the “wings” (say 10 points instead of 5). Here’s an example of the same fly starting at $235, but with 10 point wings:

A 10-point directional fly

As you can see, the profitable area of my fly (the “tent”) is wider, but my cost is $182.50 rather than $52. So I get more room and higher starting theta, but I’m paying up for it. But $182.50 is still better than the put and the vertical with respect to risk.

Conclusion

So, what’s the best way to do this? There isn’t a best way. All three strategies have pluses and minuses. Risk vs reward, time decay, and area of profitability are all factors in choosing a strategy. The point of this post isn’t to sell one strategy over another, but rather to show that in the world of options, there are multiple ways to do things and the more tools you have at your disposal, the more you can decide what kind of trade works for you.

Any questions or comments? What kind of directional plays do you like? I’d love to hear from you so feel free to leave a comment here or reach out to me on Gab @MidwayGab or on my BitChute channel MidwayTrades. I’d love to talk about what people are doing or even try to explain some concepts if that helps. I’m always learning as well so let’s talk options!

This content is free to use and copy with attribution under a creative commons license.