A Deeper Dive on Adjustments

This post is a follow-up to my previous post “The Art of Adjusting”. In that post, I gave an example of how I adjusted a trade. While the point of that post wasn't to get into the choice of the adjustment, I think that topic is one I'd like to cover. The first post was about why and when I adjust. This post is more about how I adjust. This is something I've been working on for years and will continue to evolve as I trade more but I think it's a good topic to cover, especially for new or even intermediate retail traders.

To reiterate my point in the last post, adjusting isn't required in any way. There is nothing wrong with putting on a trade and taking it off for a profit or a loss depending on what happens. Adjusting is, essentially, trying to buy more time for the trade to work...and it does have a price, there is no free lunch in this game.

Adjustment Concepts

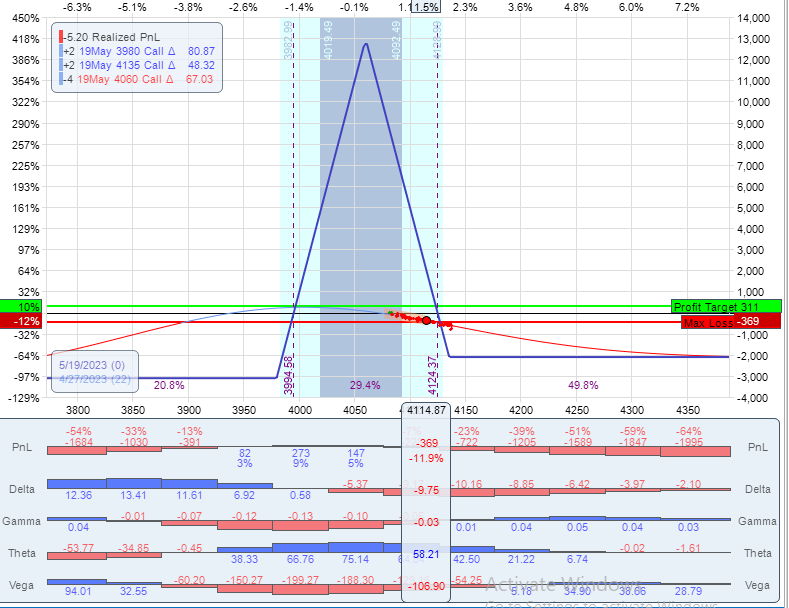

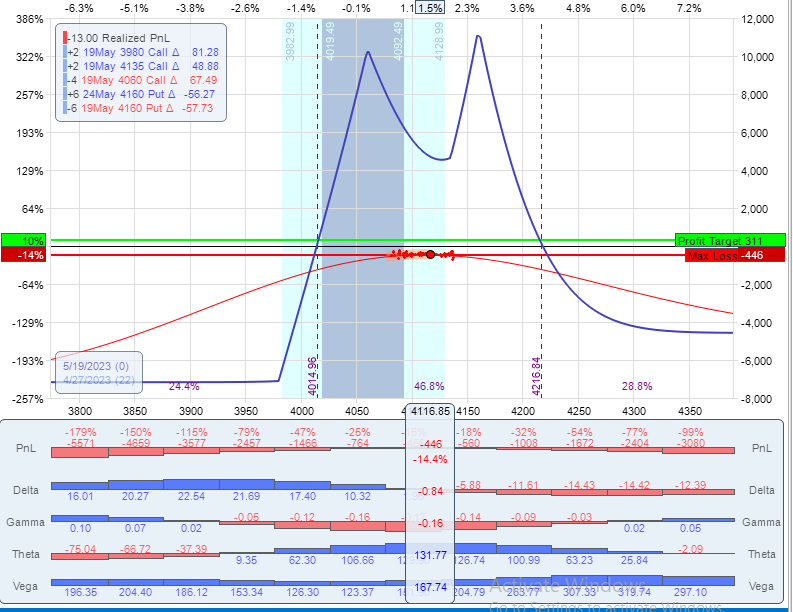

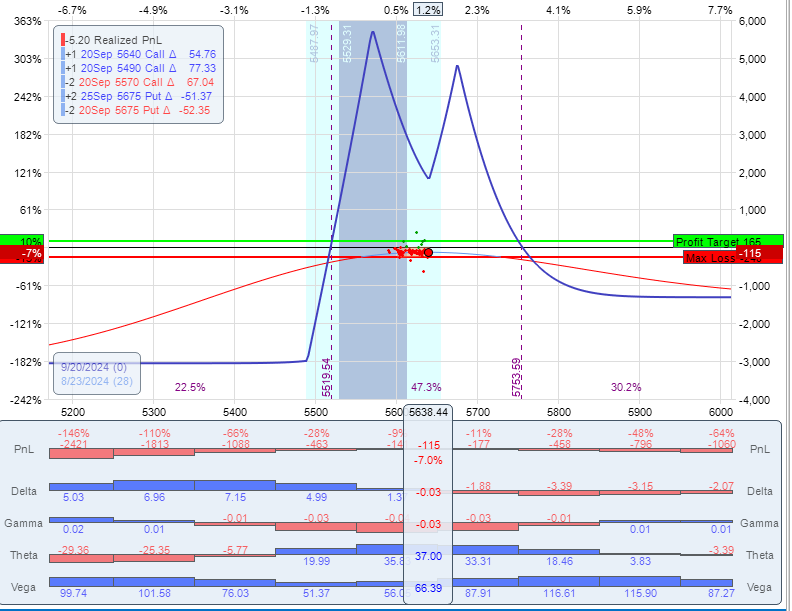

My two goals in adjusting is to buy time and lower some kind of risk. These two concepts are related and, ideally, work together to help a trade work. From a buying time perspective, the simplest way to buy time is to “expand the tent”. I will borrow the example from the last adjustment post to demonstrate that here:

As you can see, the second image has more room to move than the first. By adding the calendars to the upside I expanded the tent under which I am long theta so time works for me rather than against me. This matters because one of the ways this trade makes money is time decay. I'm selling more time decay than I'm buying which means time works in my favor (thus being positive or long theta).

However, this adjustment did more than just expand the tent and buy more time. It also reduced some risk, mostly price risk. The delta (which is one Greek that represents price risk) went from -9.75 to -0.84. That's a significant drop in price risk. At least in the short term, the price movement of SPX doesn't affect my trade nearly as much post adjustment than it did pre-adjustment. That's a double-edged sword, of course. If SPX goes down, it's much more beneficial to have -9.75 of delta than -0.84. However, this is intended to be a non-directional trade so low delta is key. It can make money on price movement, but the primary goal is to make money from extrinsic value (time and implied volatility). So lowering price risk is a good thing in this case. In addition, by adding the calendars which are also long theta, the total theta of the trade increases from 58 to 131. So the trade should benefit from time decay more post-adjustment.

But there is no free lunch in trading, it's always about trade-offs. So what did I trade-off in this adjustment? The first is total risk. I made the trade larger which increases the total risk of the trade. I always say size is the first and most important risk management tool. This trade started out with $3,100 of risk. Post-adjustment that total risk is $5,575. That's a significant increase in the risk of the trade. While I intend to manage the risk so that I don't lose the maximum amount, it's still possible. Additionally that capital is not tied up in my account so it can't be used for other things, so there's an opportunity cost as well. For my account, this increased risk is acceptable but each trader has to consider this when making an adjustment.

There is one other interesting risk change that I made that I didn't talk about in the first post...Vega or IV risk. This trade started as a butterfly which is short Vega, i.e. it benefits when IV goes down. In general, IV is opposite of price. When price goes up, IV goes down, and vice versa. How much depends on the speed of the move and there are exceptions to this, usually at some sort of extreme end. One of the fundamental pillars of my trading thesis is that volatility is, ultimately, mean reverting. So I tend to be a contrarian when it comes to IV. As IV goes up, I want short Vega, when IV is low, I like to be long Vega. I can't predict when it will revert, but I bet that it will happen soon enough. I could 100% be wrong about the timing but if I have to pick a direction, that's what I pick.

Given my thesis about IV, why add calendars to the upside? Unlike butterflies, calendars are long vega, usually quite long vega. I am making the adjustment in this case because SPX went up which typically means IV is coming down. Thus I want to be less short Vega or even long Vega post-adjustment. The other consideration is what if SPX reverses and the calendars are no longer needed? That would be a down move which usually means IV will rise. That benefits the calendar that I will likely take off which means while I still may close it for a loss, it could be less of a loss if the calendar got a boost from a move up in IV. In the example above my trade went from -106 Vega to 167. That's a big jump and, looking back, probably too much of a jump. This is why I review every trade. It leads me to tweak my strategies over time. But the theory here is that if IV is falling, I should get longer Vega and I certainly did that here. Now I'll show a more recent example of this where I made a change based on the trade above.

A New Example

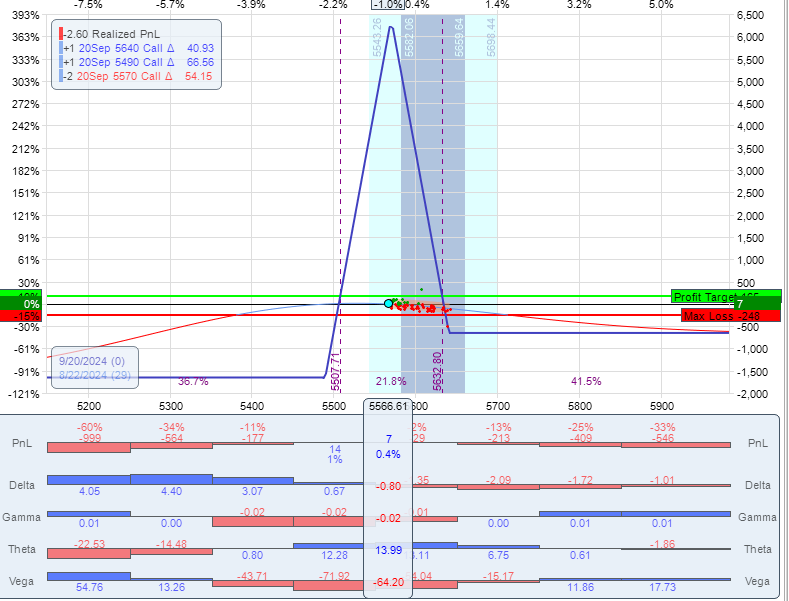

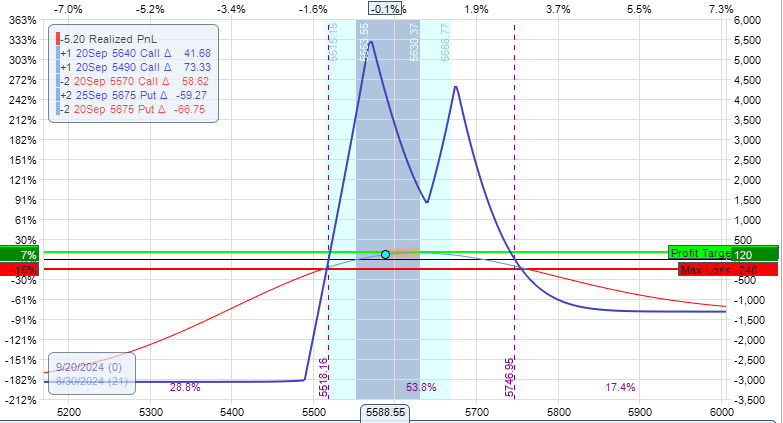

About 10 days ago (Aug 22, 2024) I put on a 29-day SPX butterfly centered at 5570 in the calls with wings 70 up and 80 down. I chose a butterfly because VIX (which is one indicator of volatility in SPX) was 17.69 which is on the high side over the past few years so I wanted to be short Vega. It's a small trade for me, a 1-lot with $1,650 of risk.

As you can see this is near the money with low price risk (–.80 Delta and –.02 Gamma), 14 theta and short Vega (-64). This is classic non-directional trade. The idea is that as long as SPX stays in the price tent (between 5507 and 5632), the trade will make money on time decay. There is less risk at the start on the downside than than the upside although at the extremes it's the other way around because the lower wing is further away than the upper wing. Most of the time in this trade my first adjustment would be to the upside since short deltas would work against me. And that's exactly what happened...the very next day.

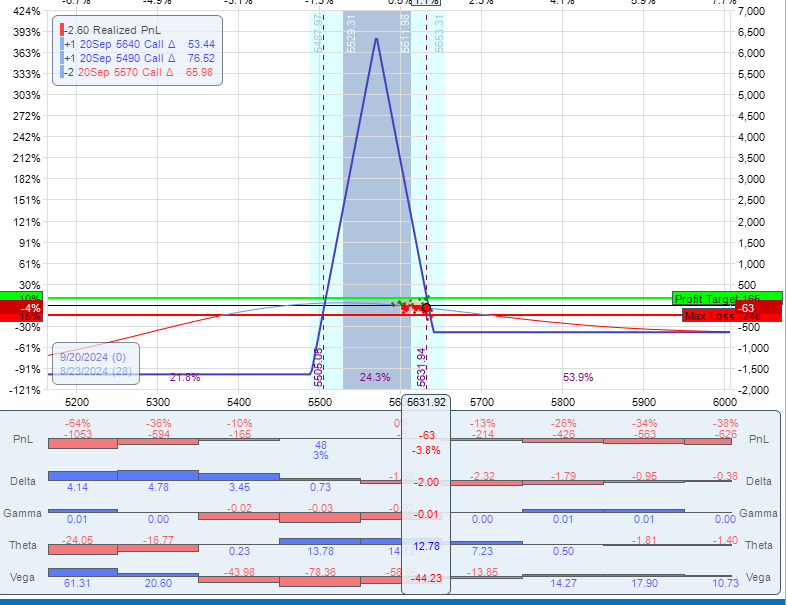

So early in the day, SPX went right to my adjustment point. Not good. I'm down about 3.5%. It looks like I got a little help from Vega as IV came down but not enough to compensate for the fast move up. In the first hour of trading, SPX is up about 1.5 standard deviations, not common, but it happens. Now is the time I'm glad it's only a 1-lot. My price risk has increased to -2 deltas. Not horrible, but not great on a 1-lot that started with less than -1. My biggest issue here is the speed. Had SPX slowly climbed up here I would not be as concerned but this could get out of hand if I don't do something. I could just take it off for a small loss. Nothing wrong with that and if I hadn't found an adjustment I liked, that's what I would have done. Some trades just don't work. But I did model a few options and decided to make an adjustment. I added 2 calendars to the upside at 5675 in the puts.

So that's what I did, but what's more important here is why I did it. First, I gave myself a good amount of room if SPX keeps going up. The calendars are centered about 37 points above the current price. Second, I cut my price risk significantly from -2.0 deltas to -0.03. I upped my theta from 13 to 37 and I flipped my Vega from the original -64 to +66. Remember, we just had a big up move so IV came down, so I'm ready to flip to being long Vega in case of a snap back. So if we do snap back, my calendars won't do as much damage thanks to their long Vega and if we keep going up, I have almost 40 more points before I'd need to look at adjusting again. In exchange for that I increased my risk from $1,650 to $2,315, about 40%. That's acceptable to me given the other risk changes. This is why I chose to make the adjustment. Recall in the first trade I increased my risk by 80% (almost double). I used to always double up on these types of adjustments. I have since learned that this isn't always necessary. I was able to buy more time at a reasonable cost that lowered my most immediate risk (price movement) in a way that if I'm wrong and the market reverses I'll take less damage. If I hadn't found something like this, I would have taken it off and tried something else.

So, what ultimately happened? I stayed in this configuration for a week. SPX did, in fact calm down and I was given time to build theta over time. Eventually SPX did come back down and the long Vega that I created by adding the calendars helped the trade. I ended up taking it off for about 6.5% in 8 days.

Was this my best trade? No, it wasn't even my best trade that month. However, in a time when my underlying moved quite a bit in a week, it made money. Usually my best trade just work and no adjustments are needed. But, as shown in this case, I was able by adjusting to turn a trade that started off in a difficult position and could have easily been a loss and made it a moderate winner.

Reviewing This Trade

As I said before, I review every trade I do whether it's a winner or not. In doing that review, one might say that if I hadn't adjusted it and just held on, it would have done better. And that is absolutely correct. In retrospect, the adjustment was entirely unnecessary. SPX came back well within the original tent of the butterfly. The fly would have closed for a better profit in less time. This is all true. However, this is relying on 20/20 hindsight. We know now that this would have happened, but there was no way to know that for sure at the time. My goal is to manage risk and that happens in real time. Sometimes managing the risk means profits take longer, come in less, or cause losses where hanging on would have won. There is no sure fire way to always win and sometimes adjusting ends up being the wrong thing to do. We can't see the future. The best we can do is manage risk in the present. In this case, I don't think I would have done it differently. This is an important part of trading...learning from your trades. I learned from the first example trade that I'd prefer to find an adjustment that doesn't add as much risk to the trade and doesn't flip Vega quite a far. And I do that in the 2nd trade. Reviewing the 2nd trade, I didn't decide to change how I trade but it was good experience in trading turbulent markets. I hope these examples give you not only ideas about how to trade, but help show you the methodology and mindset of my trading. My way isn't the only or even the best way, but what's important is understanding how to learn to become a good trader. It's a continual process. My goal here is to show that process. Hopefully this helped do that.

This content is free to use and copy with attribution under a creative commons license.